What Occurs If The Market Crashes AFTER You Purchase A Home?

What Occurs If The Market Crashes AFTER You Purchase A Home?

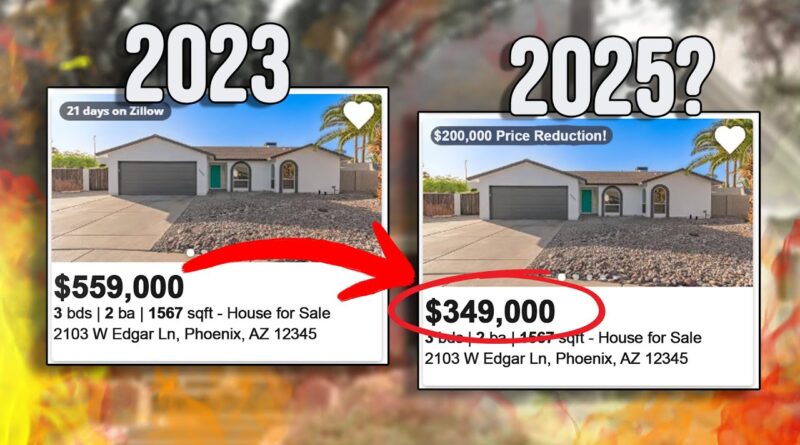

So, you lastly did it. You purchased a home and you are feeling such as you’ve achieved a significant milestone in your life. However then, you hear the information that the housing market is crashing, and abruptly, your dream house is value a fraction of what you paid for it. It is a nightmare state of affairs that many individuals worry, however what would actually occur if the market took a flip for the more severe after you purchased a home?

Let’s break it down and discover three completely different eventualities to see how every one would fare within the occasion of a market downturn. However first, let’s speak about how the housing market works when it takes a success.

Not like shares, the place you may simply observe the worth of an organization primarily based on its share worth, the worth of a home is decided by comparables – what related homes within the space are promoting for. So, for those who purchased a home for $420,000, its worth can be influenced by the sale costs of comparable homes within the neighborhood. If a neighbor sells an analogous home for $440,000, your own home is now value $440,000. But when they promote for $400,000, your own home’s worth would lower accordingly.

A market crash does not imply that your own home’s worth will plummet in a single day. It is a gradual course of that may take months and even years to unfold. And simply as costs can drop, they’ll additionally rise once more if extra consumers enter the market.

Now, let’s contemplate three completely different folks and the way they’d fare within the occasion of a market crash.

Situation 1: Emotional Purchaser Sam

Sam purchased a home as a result of they felt pressured to take action, despite the fact that their monetary scenario wasn’t superb. They stretched their finances to purchase a $420,000 home, despite the fact that it was a good portion of their revenue. When the market crashes, Sam’s home worth decreases, and so they discover themselves struggling to make mortgage funds.

Situation 2: Conservative Purchaser Alex

Alex purchased a home inside their means, choosing a extra inexpensive $300,000 residence. They made certain that their mortgage funds have been manageable, even when the market took a success. When the market crashes, Alex’s home worth decreases, however they’re nonetheless capable of comfortably afford their mortgage.

Situation 3: Affected person Purchaser Taylor

Taylor determined to attend and save up more cash earlier than shopping for a home. When the market crashes, Taylor is in a powerful monetary place to benefit from decrease costs and purchase a home at a reduced fee.

In every state of affairs, the end result is influenced by the alternatives made when shopping for a home. Emotional consumers like Sam are extra weak to market crashes, whereas conservative consumers like Alex are higher ready to climate the storm. Affected person consumers like Taylor may even profit from a market downturn.

So, what occurs if the market crashes after you purchase a home? All of it depends upon the alternatives you make at this time. Whether or not you are an emotional purchaser, a conservative purchaser, or a affected person purchaser, your method to purchasing a home can considerably influence the way you fare within the occasion of a market downturn.

Last Ideas

Shopping for a home is a major monetary resolution, and it is important to think about the potential influence of a market crash. By making knowledgeable and strategic decisions, you may higher place your self to navigate the ups and downs of the housing market. Whether or not you are shopping for your first residence or contemplating an funding property, understanding the dynamics of the housing market is essential for long-term monetary stability.