What If The Federal Reserve Raises Charges As an alternative Of Slicing?

At Inman Connect Las Vegas, July 30-Aug. 1, 2024, the noise and misinformation will probably be banished, all of your large questions will probably be answered, and new enterprise alternatives will probably be revealed. Join us.

What if, as an alternative of cutting rates three times this year to assist a decelerating financial system obtain a “comfortable touchdown,” Federal Reserve policymakers as an alternative see inflation proceed to run hotter than they want and find yourself elevating charges as an alternative?

It’s not their base case, but when that “no touchdown” situation turns into actuality, it might ship mortgage charges hovering above 8 p.c subsequent 12 months and put inventory markets right into a tailspin, analysts at UBS Group AG mentioned this week.

“If the growth stays resilient and inflation will get caught at 2.5 p.c or greater, there can be actual threat the [Fed] resumes elevating charges once more by early subsequent 12 months,” UBS strategists, together with Jonathan Pingle and Bhanu Baweja, mentioned in a notice to shoppers.

UBS, which had beforehand anticipated the Fed to chop charges by 2.75 share factors this 12 months, is now projecting simply two 25 basis-point cuts totaling a paltry half a share level, Bloomberg Information reported.

That’s UBS’ baseline situation. The worst-case situation is that inflation retains defying expectations, and the Fed as an alternative raises charges by a full share level, bringing the federal funds short-term borrowing charge to six.5 p.c by mid-2025.

Simply the prospect of a Fed charge hike can have a significant impression on lenders and inventory market buyers, no matter whether or not it truly occurs, Michael Contopoulos, director of mounted revenue at Richard Bernstein Advisors, told Yahoo Finance.

“I put the percentages as not a lot that I feel they are going to hike, as a lot as I feel that the market will begin to value in some chance of a hike,” Contopoulos mentioned.

For now, futures markets nonetheless assume the percentages that the Fed will elevate charges as an alternative of reduce them are nil. The CME FedWatch Tool, which tracks investor sentiment to gauge the chance of future Fed strikes, on Monday put the percentages that the federal funds charge will probably be greater in June 2025 at 0 p.c.

Traders had been pricing in lower than a 2 p.c probability that Fed policymakers will nonetheless be sustaining their present federal funds goal charge of 5.25 to five.50 in June 2025, and a 98 p.c probability of a number of charge cuts.

However with inflation knowledge continuing to come in hot, futures market buyers now put the percentages of a number of Fed charge cuts by this June at simply 22.5 p.c, down from 59 p.c a month in the past.

Within the meantime, mortgage charges have already reclaimed a lot of the territory ceded final 12 months by bond market buyers who fund most house loans.

After falling from a 2023 peak of seven.83 p.c registered on Oct. 25 to a 2024 low of 6.50 p.c on Feb. 1, charges on 30-year fixed-rate loans climbed again above 7 p.c final week, in response to mortgage lock knowledge tracked by Optimum Blue.

Mortgage charges are more likely to proceed to rise this week, with 10-year Treasury yields spiking by 13 foundation factors Monday following the discharge of stronger than anticipated March retail and meals companies gross sales knowledge.

After adjusting for seasonal variation however not inflationary value will increase, retail and meals companies gross sales had been up 0.7 p.c from February to March and 4 p.c from a 12 months in the past to $709.6 billion, the Census Bureau reported.

Dip in ’30-10 unfold’ a silver lining

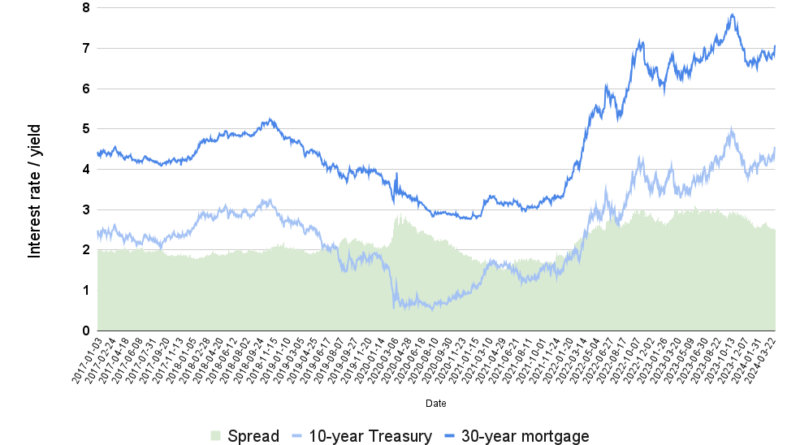

Supply: Optimum Blue and Federal Reserve knowledge retrieved from FRED, Federal Reserve Financial institution of St. Louis.

Whereas 10-year Treasury yields are a helpful barometer for the place mortgage charges may very well be headed subsequent, one piece of excellent information for these involved about greater borrowing prices for owners is that the “30-10 unfold” between mortgage charges and 10-year Treasury notes has eased.

The unfold, which averaged two share factors earlier than the pandemic, spiked above three share factors at instances final 12 months as buyers demanded greater returns on mortgage-backed securities (MBS) in comparison with Treasurys.

A part of the expansion within the 30-10 unfold was that, with the Fed anticipated to chop charges in 2024, MBS buyers began demanding greater returns to compensate them for the elevated prepayment threat posed by debtors after they’re extra more likely to refinance.

Within the hopes of offering reduction to mortgage debtors, final 12 months actual property and lending trade teams pleaded with the Fed to cease winding down its large MBS portfolio to cut back the unfold. As an alternative of letting $35 billion in MBS roll off its books every month, the Fed might buy new mortgages to interchange maturing belongings, the teams mentioned.

After the Fed’s final assembly, Powell mentioned that the central financial institution is getting ready to gradual the tempo of its steadiness sheet “quantitative tightening.” However as a result of mortgage charges are nonetheless too excessive to present owners a lot incentive to refinance, the Fed has solely been in a position to trim its MBS holdings by about $15 billion a month, lower than half of its $35 billion month-to-month goal.

Nonetheless, with fading expectations for giant Fed charge cuts, the 30-10 unfold has already been shrinking. The unfold, which averaged 2.87 share factors final 12 months and a pair of.58 share factors this 12 months, has dipped beneath 2.50 share factors twice in April — a threshold not breached since June 2022.

Get Inman’s Mortgage Brief Newsletter delivered proper to your inbox. A weekly roundup of all the largest information on the planet of mortgages and closings delivered each Wednesday. Click here to subscribe.