Video #14 Actual Property Funding Methods Maximizing Wealth

As a seasoned actual property investor, I’ve discovered a factor or two about maximizing wealth by means of strategic funding methods. On this article, I will delve into the important thing elements that contribute to constructing wealth in actual property, with a selected concentrate on appreciation and exit methods.

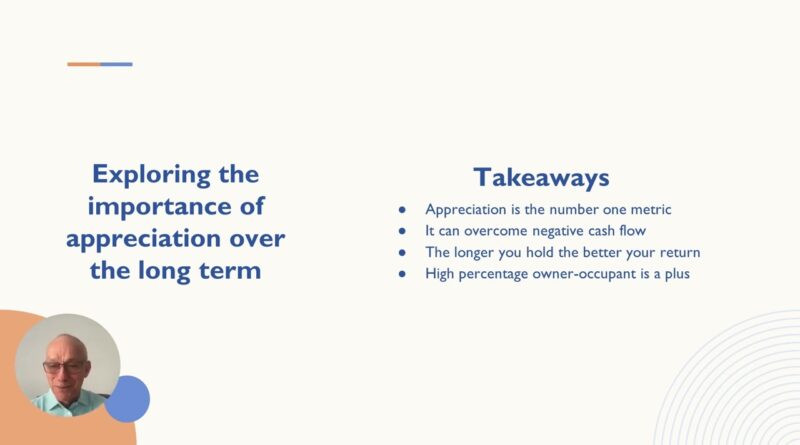

Understanding the Energy of Appreciation

Relating to actual property funding, the idea of appreciation is paramount. As the worth of a property will increase over time, so does the potential for wealth accumulation. In reality, appreciation is commonly the primary metric that may make a big distinction in your long-term wealth.

Within the video, the speaker emphasizes the significance of figuring out neighborhoods and cities with regular or quickly rising appreciation charges. This can be a essential issue to contemplate when evaluating potential funding alternatives. The instance supplied within the video illustrates how even with destructive money movement, the substantial appreciation of the property resulted in a 24% annual return on funding. This demonstrates the immense influence that appreciation can have in your total wealth-building technique.

Proprietor Occupancy and Neighborhood Dynamics

One other key level highlighted within the video is the importance of proprietor occupancy in a neighborhood. The speaker emphasizes the correlation between the next proportion of owner-occupied properties and the potential for higher appreciation. This perception underscores the significance of conducting thorough analysis into the demographics and dynamics of a neighborhood earlier than investing resolution.

Moreover, the speaker advises in opposition to investing in neighborhoods with a excessive focus of rental properties, as this could be a pink flag for potential depreciation. By specializing in neighborhoods with a excessive proprietor occupancy price, traders can place themselves for long-term wealth accumulation by means of property appreciation.

The Energy of Compound Curiosity

The video references a quote by Albert Einstein, who famously referred to compound curiosity because the eighth surprise of the world. This timeless knowledge underscores the elemental precept of wealth accumulation by means of the compounding impact of appreciation. By leveraging the facility of compound curiosity, traders can harness the exponential progress potential of their actual property investments over time.

Exit Methods and Lengthy-Time period Planning

Along with understanding the dynamics of appreciation, it is equally essential to contemplate exit methods when formulating an actual property funding plan. Whereas some traders might initially intend to carry onto their properties indefinitely, unexpected circumstances or altering market situations might necessitate a strategic exit technique.

The video emphasizes the significance of incorporating an exit technique into each funding dialog. Whether or not it is a deliberate sale sooner or later or a contingency plan for surprising circumstances, having a transparent exit technique is important for long-term wealth preservation and progress.

Wanting Forward: Leveraging Funding Methods for Actual Property

As we navigate the complexities of actual property funding, it is essential to acknowledge the transformative energy of appreciation and the strategic significance of exit planning. By aligning our funding methods with the rules outlined within the video, we will place ourselves for long-term wealth maximization and monetary safety.

In conclusion, the insights shared within the video make clear the elemental rules of actual property funding methods for maximizing wealth. By embracing the facility of appreciation, understanding neighborhood dynamics, and incorporating considerate exit methods, traders can chart a course in direction of sustainable wealth accumulation and monetary prosperity.

Key Takeaways for Actual Property Funding Success

As we mirror on the dear insights introduced within the video, it is clear {that a} complete understanding of appreciation, proprietor occupancy dynamics, and strategic exit planning is important for profitable actual property funding. By integrating these key rules into our funding method, we will pave the way in which for long-term wealth maximization and monetary safety.

As we proceed our journey within the realm of actual property funding, let’s leverage these foundational rules to construct a strong framework for sustainable wealth accumulation and monetary prosperity. With a strategic concentrate on appreciation, neighborhood dynamics, and considerate exit planning, we will navigate the complexities of actual property funding with confidence and experience.