URGENT: Federal Reserve ENDS Charge Hikes, Costs Fall, Huge Pivot Forward!

Hey there, it is nice to have you ever right here as a result of at this time we’re diving into some fairly large information that is going to have a significant impression in your funds. If you happen to’ve been keeping track of the Federal Reserve and their price hikes, you will need to pay shut consideration to what’s been taking place. The latest resolution to pause price hikes for the remainder of 2023, and the prediction that the FED is finished elevating rates of interest altogether, goes to shake issues up available in the market.

Let’s begin by inflation, which is a key issue within the FED’s decision-making course of. The FED desires inflation to return to its 2% goal earlier than they begin lowering rates of interest. The excellent news is that total inflation has improved, with a lower from 3.2% to three.1%. Nonetheless, some classes, like automobile insurance coverage, have seen vital worth will increase, with premiums rising by a whopping 19.2% year-over-year. Then again, core CPI, which excludes extra unstable classes like meals and power, has elevated by 0.3%, primarily attributable to rising costs in companies like medical care and tuition.

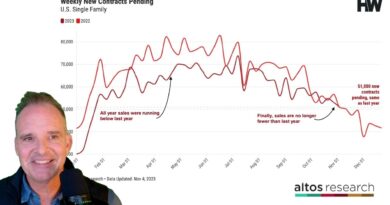

Now, let’s discuss in regards to the housing market. House costs have skyrocketed by 55% year-over-year, making it more and more unaffordable for patrons. Nonetheless, specialists predict that the times of insane worth beneficial properties are over, and we might even see a extra modest 2% residence appreciation atmosphere in 2024. The truth is, some areas are anticipated to see residence costs fall, whereas others might expertise worth beneficial properties. This shift within the housing market is one thing to control, particularly if you happen to’re contemplating shopping for or promoting a house.

Shifting on to the inventory market, it is necessary to keep in mind that inventory costs do not all the time behave rationally. The market is not all the time a mirrored image of the financial system, and there are numerous elements at play which can be past our management. Nonetheless, it is essential to remain knowledgeable and be ready for any potential market shifts.

In conclusion, the latest resolution by the Federal Reserve to pause price hikes and the prediction that they’re finished elevating rates of interest altogether goes to have a major impression on varied points of the financial system, from inflation to the housing market and the inventory market. It is important to remain knowledgeable and be ready for potential adjustments within the coming yr.

So, what do you consider these latest developments? How do you suppose they are going to impression your funds? Let’s maintain the dialog going within the feedback under!