Trump Media misplaced $58 million final 12 months, SEC submitting exhibits

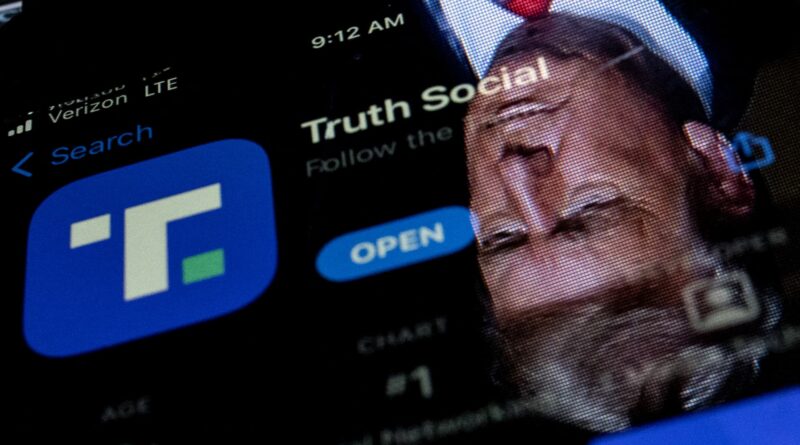

This photograph illustration exhibits a picture of former President Donald Trump mirrored in a cellphone display screen that’s displaying the Reality Social app, in Washington, DC, on February 21, 2022.

Stefani Reynolds | AFP | Getty Pictures

The share worth of Trump Media fell sharply Monday morning after the social media app firm carefully tied to former president Donald Trump reported a web lack of $58.2 million on income of simply $4.1 million in 2023.

Trump Media & Technology Group shares had been buying and selling down by greater than 18.8% as of 12:38 a.m. ET.

Regardless of that plunge, the corporate’s market capitalization was nonetheless greater than $6.8 billion after its 8-Okay submitting with the Securities and Exchange Commission revealed the loss for final 12 months.

A lot of the web loss seems to return from $39.4 million in curiosity expense, based on the submitting.

A spokesperson for the corporate didn’t instantly reply to a request for touch upon the brand new submitting.

The submitting exhibits that in 2022, Trump Media had a web revenue of $50.5 million and complete income of solely $1.47 million.

The corporate ended 2023 with simply $2.7 million in money readily available, the submitting mentioned.

The losses final 12 months by Trump Media — the proprietor of the Truth Social app routinely utilized by the previous president — might proceed for a while, based on the corporate.

“TMTG expects to incur working losses for the foreseeable future,” says the submitting, which got here per week after the corporate started buying and selling below the ticker DJT on the Nasdaq.

The submitting additionally warns shareholders that Trump’s involvement within the firm might put it at larger threat than different social media corporations.

TMTG additionally disclosed to regulators that the corporate had recognized “materials weaknesses in its inside management over monetary reporting” when it ready a earlier monetary assertion for the primary three quarters of 2023.

As of Monday, Trump Media mentioned these “recognized materials weaknesses live on.”

Trump owns 57.3% of Trump Media shares, a stake valued at greater than $4 billion, which Forbes final week mentioned would symbolize effectively greater than half of his complete web price.

He additionally stands to obtain one other 36 million shares of so-called “earn-out” shares over the following three years, so long as Trump Media’s inventory throughout that point hits a sequence of worth benchmarks. These targets are all effectively beneath the corporate’s inventory worth early Monday.

Trump Media’s share worth rocketed when its inventory started buying and selling Tuesday, a number of days after the agency merged with a particular objective acquisition firm, Digital World Acquisition Corp., which had been traded below the ticker DWAC. The newly merged firm now trades below Trump’s initials, DJT.

Analysts observe that the corporate’s excessive valuation is partly as a result of inventory purchases by Trump’s political supporters, who’re smitten by proudly owning a part of an organization so carefully related to the presumptive Republican presidential nominee.

That enthusiasm creates distinctive dangers for the corporate, nevertheless. The brand new 8-Okay submitting says that Trump Media “could also be topic to larger dangers than typical social media platforms due to the main focus of its choices and the involvement of President Trump.”

“These dangers embrace lively discouragement of customers, harassment of advertisers or content material suppliers, elevated threat of hacking of TMTG’s platform, lesser want for Reality Social if First Modification speech will not be suppressed, criticism of Reality Social for its moderation practices, and elevated stockholder fits.”