Trump Media is the most costly U.S. inventory to quick — by far

You want quite a lot of money — and guts — to quick Trump Media inventory proper now.

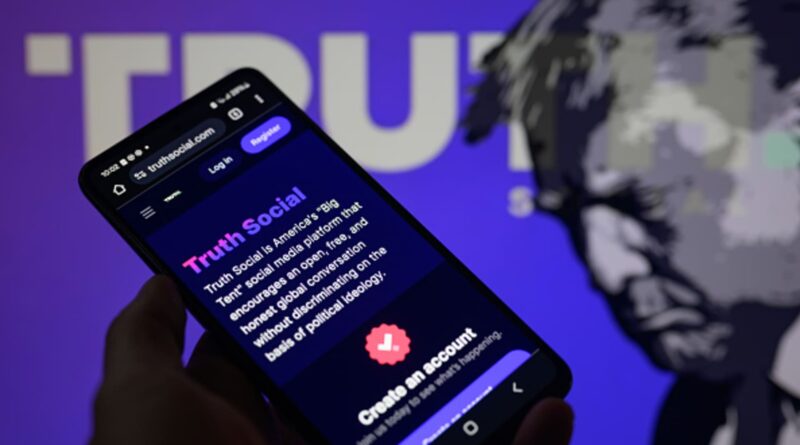

Trump Media, which started being publicly traded final week, is now far and away the most costly U.S. stock to promote quick, based on S3 Partners, a number one monetary knowledge market platform.

However loads of persons are nonetheless prepared to pay these steep prices, primarily based on their perception that Trump Media’s share worth is certain to fall dramatically from its Wednesday closing of $48.81.

Buyers who wished to borrow Trump Media shares to promote them quick on Wednesday would have needed to pay annual financing prices of between 750% and 900% of the value of the inventory, stated Ihor Dusaniwsky, managing director of predictive analytics at S3 Companions.

Which means a brief vendor of the DJT ticker who took a place Wednesday would have needed to pay prices of between about $1 and $1.22 per day to the lenders.

To interrupt even on a brand new commerce after one month, a brief vendor must see the share worth of Trump Media drop by greater than $30.

That could possibly be a tricky place to be in, given the truth that lots of Trump Media’s shareholders are particular person traders motivated to purchase the inventory by their help for former President Donald Trump, the corporate’s majority shareholder and the very best profile person of its Fact Social app.

Buyers who began short-selling Trump Media sooner than Wednesday are paying much less in prices, that are collected on the finish of every month, Dusaniwsky famous. However not that a lot much less.

Current quick positions in Trump Media had been paying prices of 565% yearly on Wednesday, he stated.

For comparability, the typical inventory borrow financing price for a brief place was simply .71%.

“It is the most costly inventory borrow,” Dusaniwsky stated of Trump Media. “Day-after-day the inventory has to go down 78 cents simply to make up financing prices, simply to place you to zero.”

“Persons are searching for a unprecedented worth drop in a particularly quick time frame,” he stated. “If you happen to’re speaking about holding your inventory for a month, the inventory has to drop by greater than a half for this to be worthwhile.”

Dusaniwsky characterised Trump Media’s quick sale monetary prices as “terribly uncommon.”

“It is a ‘black swan’ occasion,” he stated. “As one thing that is a official commerce, that is means, means, out on the curve.”

The second-most costly inventory to quick Wednesday was Cover Progress, whose quick sellers had been on the hook for prices of 198% of the inventory worth yearly, based on S3 Companions knowledge.

Brief sellers in Past Meat, the third-most costly inventory by prices to quick, would have paid 79% yearly.

Brief sellers are successfully betting {that a} inventory’s worth will drop under the value at which they borrowed the shares that they then bought. If the value does fall, they will purchase shares to return them to the lenders, pocketing the value distinction.

But when the share worth rises, they are often pressured into the uncomfortable place of getting to purchase shares and lose cash on the dealer or enhance the collateral they posted to safe the commerce — a “quick squeeze.”

As of Wednesday, the quick curiosity in Trump Media — or the worth of shares borrowed for brief trades — was about $255 million. A lot of these quick positions had been acquired in Digital World Acquisition Corp., the publicly traded shell firm whose merger in late March with Trump’s social media firm led to Trump Media turning into publicly traded.

In March, quick sellers’ positions in DWAC after which in Trump Media had been down about $126 million in so-called mark-to-market losses, a drop of almost 70% for the month.

Regardless of that and regardless of Trump Media’s excessive price to promote quick, loads of traders are eager about doing simply that.

They’re drawn by the truth that the share worth offers it a market capitalization of $6.6 billion regardless of having simply $4.1 million in income final 12 months.

“What I am listening to on the Road is that if [an amount] of inventory turns into obtainable, shorts are taking it down,” Dusaniwsky stated.

When Trump Media went public final week, its worth skyrocketed by greater than 50% p.c throughout the first minutes of buying and selling, to a excessive of $79.38 per share.

However on Monday, the share worth plunged 21% after Trump Media reported a lack of $58 million in 2023.

Dusaniwsky stated that quick sellers in Trump Media had been entering into these trades as a result of “they assume this inventory is overbought” and that there’s a actual alternative to generate profits from a dramatic worth drop.

These sellers are “hoping to make a 20-plus p.c return on that commerce,” which implies the share worth must fall by as much as 70% to cowl the financing prices of the commerce, he stated.

The traders who can borrow shares from their brokers for a Trump Media quick sale are “good prospects” of these brokers, he stated.

“When the inventory borrow turns into this tough, solely one of the best purchasers are getting that,” he stated. And one of the best purchasers are those with the reserves of inventory or different collateral to cowl their positions, he added.

However getting shares to borrow to promote quick is more and more tough. Out of about 5 million shares of Trump Media obtainable to quick, 4.94 million have been already borrowed, which drives up the financing prices.

“That is now a squeezable inventory as a result of the shorts are dropping cash, the rates of interest are so excessive, and there is additionally a recall threat,” Dusaniwsky stated, referring to a scenario when a dealer must get hold of shares from a brief vendor to promote for a buyer in an extended commerce place who initially purchased the shares on margin.

Dusaniwsky stated quick sellers are in a good spot as a result of lots of Trump Media shareholders should not within the temper to promote their shares, and thus drive down the value, and since there are so few shares to borrow and promote quick.

— Extra reporting by CNBC’s Nick Wells