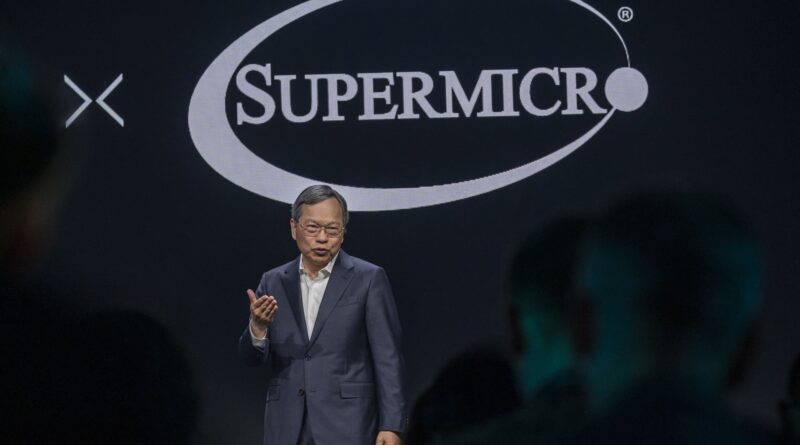

Tremendous Micro becoming a member of S&P 500 after 20-fold leap in inventory in two years

David Paul Morris | Bloomberg | Getty Photos

Super Micro Computer is becoming a member of the S&P 500 following a historic rally within the inventory that is pushed the corporate’s market cap previous $50 billion.

The shares, up greater than 20-fold prior to now two years and over 200% simply because the begin of 2024, climbed one other 8% in prolonged buying and selling on Friday.

Tremendous Micro is changing Whirlpool, in response to a press launch. Deckers Outdoor can be becoming a member of the S&P 500, changing Zions Bancorp.

Shares added to the benchmark index typically rise in worth as a result of funds that monitor the S&P 500 will add it to their portfolios. The median market cap for firms within the S&P 500 is $33.7 billion.

Tremendous Micro has been one of many most important beneficiaries of the substitute intelligence growth sweeping the expertise trade. The corporate makes servers and different laptop infrastructure, and it is one of many major distributors for constructing out Nvidia-based “clusters” of servers for coaching and deploying AI fashions.

Within the quarter ended December, Tremendous Micro’s income greater than doubled to $3.66 billion. Analysts anticipate gross sales within the present quarter to greater than triple.

“We see Nvidia’s outcomes as a optimistic knowledge level for SMCI which is likely one of the main companions that designs and manufactures servers to wrap across the GPUs and customizes racks to the particular wants of a buyer,” Financial institution of America analyst Ruplu Bhattacharya wrote in a notice final month. He has a purchase ranking on the inventory.