This is How Zillow’s New “Tremendous App” Is Driving Income Progress

Zillow’s newest momentum is a manifestation of its technique to diversify income throughout the transaction because it transitions from a lead-generation platform to a housing “super app.”

Zillow’s newest momentum is a manifestation of its technique to diversify income throughout the transaction because it transitions from a lead-generation platform to a housing “super app.”

Why it issues: As Zillow scales new income streams, together with Zillow Residence Loans, Leases, ShowingTime+ and Vendor Options, it’s planting essential seeds for its subsequent section of progress.

Context: After a pandemic bump, Zillow’s general income declined and has remained flat since 2021 — throughout one of many worst actual property markets ever recorded.

Over a difficult two years, Zillow’s residential and mortgage companies have shrunk (on par with the declining market) whereas its leases enterprise has ticked up from sturdy natural progress.

Even with flat income, Zillow has considerably outperformed the market throughout this era, with the magnitude depending on whether or not you think about Zillow a lead-generation platform or a housing “tremendous app.”

Even with flat income, Zillow has considerably outperformed the market throughout this era, with the magnitude depending on whether or not you think about Zillow a lead-generation platform or a housing “tremendous app.”

- Whereas income progress at Zillow, the lead-generation platform, has barely outperformed the market, income progress at Zillow, the housing super app, is outperforming at a a lot larger fee.

- This can be a results of new services and products which are producing further income throughout extra of the transaction.

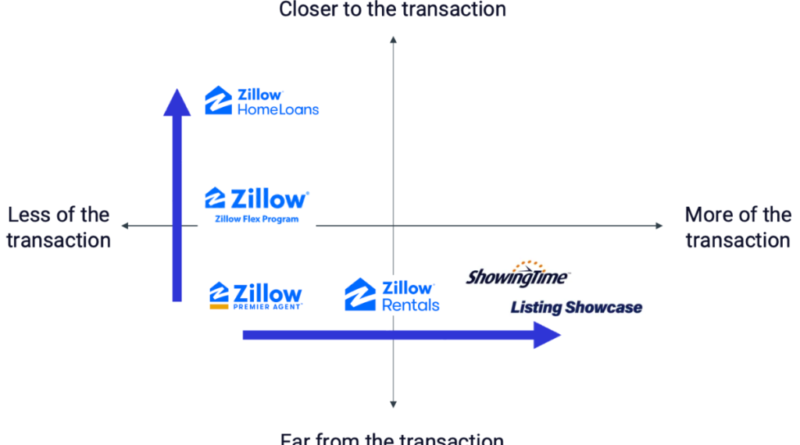

Dig deeper: For years I’ve used the next framework to consider actual property portal progress technique.

- Zillow’s evolving technique sees it getting nearer to the true property transaction (Zillow Flex and Zillow Residence Loans) and increasing to extra components of the transaction (mortgages, leases, vendor companies, agent instruments).

- Usually, companies nearer to the transaction are larger income, whereas companies farther from the transaction are larger margin and extra scalable.

Zillow asserts that its technique to develop transaction and income share is working.

- The drivers of that progress — in its early enhanced markets — look like a mix of rising Zillow Residence Loans, cycling out underperforming Flex teams, and launching new vendor options (Itemizing Showcase and the Opendoor partnership).

Zillow’s mortgage enterprise is rising, however, counterintuitively, income is dropping as buy quantity practically doubles.

- This can be a results of a shifting product combine — Zillow is funneling leads from its mortgage market to success by Zillow Residence Loans.

- It’s shifting from an asset-light market to an asset-heavier mortgage brokerage operation, with a lot larger income potential.

Final yr I claimed that Listing Showcase was Zillow’s most attention-grabbing product, and now it’s most likely Zillow’s most attention-grabbing slide in its investor presentation.

- The mid-term income potential is spot on primarily based on my earlier calculations, representing a major income alternative as a brand new, sell-side product.

- However essentially the most attention-grabbing alternative is long-term, the place Itemizing Showcase may very well be rolled out as a mass-market product for all brokers.

What to observe: Zillow’s future progress aspirations hinge on a number of key elements.

- Enlargement into 40 markets — as early “enhanced markets,” Atlanta and Phoenix are helpful knowledge factors, however not essentially consultant of all 40 markets.

- The last mile problem — Zillow stays fully depending on native actual property agent groups to drive adoption of its new merchandise.

- Zillow Residence Loans is driving income, but it surely’s unprofitable, lower-quality income — the enterprise must exhibit a capability to develop income quicker than bills.

The underside line: Zillow is diversifying its income alongside the transaction — what it calls its tremendous app — and is outperforming a depressed market.

- Zillow will nearly actually miss its $5 billion in revenue by 2025 goal, however like many plans that had been laid in early 2022, issues have modified.

- Whereas early indicators are promising in a number of key markets, the trail ahead hinges on the cussed realities of conversion charges, profitability, and — as at all times — partnering with brokers.

Mike DelPrete is a strategic adviser and world skilled in actual property tech, together with Zavvie, an iBuyer supply aggregator. Join with him on LinkedIn.