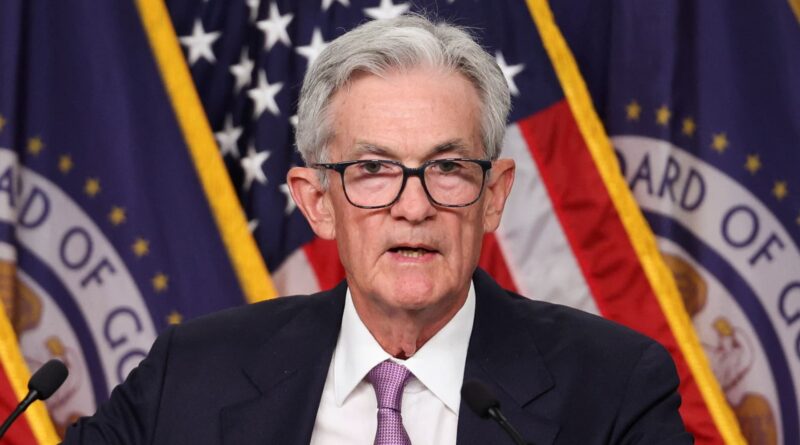

The Fed has set out on a ‘recalibration’ of coverage. This is what Powell’s new buzzword means

Federal Reserve Chair Jerome Powell has unveiled his newest buzzword to explain financial coverage, with a “recalibration” of coverage at a pivotal second for the central financial institution.

At his news conference following Wednesday’s open market committee assembly, Powell used variations of the phrase no fewer than eight instances as he sought to clarify why the Fed took the weird step of a half share level price minimize absent an apparent financial weakening.

“This recalibration of our coverage stance will assist keep the power of the economic system and the labor market, and can proceed to allow additional progress on inflation as we start the method of transferring ahead a extra impartial stance,” Powell stated.

Monetary markets weren’t fairly certain what to make of the chair’s messaging within the assembly’s rapid aftermath.

Nonetheless, asset prices soared Thursday as buyers took Powell at his phrase that the unusually outsized transfer wasn’t in response to a considerable slowing of the economic system. Moderately, it was a possibility to “recalibrate” Fed coverage away from a inflexible give attention to inflation to a broader effort to verify a current weakening of the labor market did not get out of hand.

The Dow Jones Industrial Common and S&P 500 jumped to new highs in trading Thursday after swinging violently Wednesday.

“Coverage had been calibrated for meaningfully greater inflation. With the inflation price now drifting shut to focus on, the Fed can take away a few of that aggressive tightening that they put into place,” stated Tom Porcelli, chief U.S. economist at PGIM Mounted Earnings.

“It actually permits him to push this narrative that this easing cycle isn’t about us being in recession, it’s about extending the financial growth,” he added. “I feel it is a actually highly effective concept. It is one thing we had been hoping that he would do.”

Powell’s buzzwords

A number of of Powell’s earlier efforts to supply buzzy descriptions of Fed coverage or its views on the economic system have not labored out so effectively.

In 2018, his characterizations of the efforts to scale back its bond holdings as being on “autopilot,” in addition to his evaluation {that a} string of price hikes the identical 12 months had introduced the Fed “a long way” from a neutral interest rate spurred blowback from markets.

Extra famously, his insistence that an inflation surge in 2021 would prove “transitory” ended up inflicting the Fed to be slow-footed on coverage to the purpose the place it needed to enact a sequence of three-quarter share level price will increase to tug down inflation.

However markets expressed confidence in Powell’s newest evaluation, regardless of this observe file and a few indicators of cracks within the economic system.

“In different contexts, a bigger transfer might convey higher concern about development, however Powell repeatedly pressured this was mainly a joyous minimize as ebbing inflation permits the Fed to behave to protect a powerful labor market,” Michael Feroli, chief U.S. economist at JPMorgan Chase, stated in a consumer notice. “Furthermore, if coverage is about optimally, it ought to return the economic system to a good place over time.”

Nonetheless Feroli expects the Fed must comply with up Wednesday’s motion with a similar-sized transfer on the Nov. 6-7 assembly until the labor market reverses a slowing sample that started in April.

There was some excellent news on the roles entrance Thursday, because the Labor Division reported that weekly claims for unemployment advantages slid to 219,000, the bottom since Could.

An uncommon transfer decrease

The half share level — or 50 foundation level — minimize was exceptional in that it is the first time the Fed has gone past its conventional quarter-point strikes absent a looming recession or disaster.

Although Powell didn’t give credence to the notion that the transfer was a make-up name for not slicing on the July assembly, hypothesis on Wall Road was that the central financial institution certainly was enjoying catch-up to a point.

“It is a matter of possibly he felt like they have been getting a bit of bit behind,” stated Dan North, senior economist for North America at Allianz Commerce. “A 50 foundation level minimize is fairly uncommon. It has been a very long time, and I feel it was possibly the final labor market report that gave him pause.”

Certainly, Powell has made no secret of his issues concerning the labor market, and said Wednesday that getting in entrance of a possible weakening was an essential motivator behind the recalibration.

“The Fed nonetheless sees the economic system as wholesome and the labor market as strong, however Powell famous that it’s time to recalibrate coverage,” wrote Seth Carpenter, chief international economist at Morgan Stanley. “Powell has pressured and confirmed with this price minimize that the FOMC is prepared to maneuver step by step or expand strikes relying on the incoming information and evolution of dangers.”

Carpenter is among the many group that expects the Fed now can dial down its lodging again to quarter-point increments by means of the remainder of this 12 months and into the primary half of 2025.

Futures markets merchants, although, are pricing in a extra aggressive tempo that may entail a quarter-point minimize in November however again to a half-point transfer in December, in keeping with the CME Group’s FedWatch gauge.

Financial institution of America economist Aditya Bhave famous a change within the Fed’s post-meeting assertion that included a reference to looking for “most employment,” a point out he took to point that the central financial institution is able to keep aggressive if the roles image continues to deteriorate.

That additionally means the recalibration may get tough.

“We expect the Fed will find yourself front-loading price cuts greater than it has indicated,” Bhave stated in a notice. “The labor market is more likely to stay tepid, and we predict markets will push to do one other super-sized minimize in 4Q.”