That Large Fed Price Minimize Was No Panacea For Housing, Fitch Analysts Say

Whether or not it’s refining your enterprise mannequin, mastering new applied sciences, or discovering methods to capitalize on the following market surge, Inman Connect New York will put together you to take daring steps ahead. The Subsequent Chapter is about to start. Be a part of it. Join us and 1000’s of actual property leaders Jan. 22-24, 2025.

Demand for houses stays above long-term averages, however scarce stock means gross sales aren’t more likely to decide up till mortgage charges transfer nearer to five p.c, analysts at Fitch Scores stated Thursday.

And since buyers who fund most mortgages had already priced in Wednesday’s Fed charge lower, they might must get much less skittish concerning the dangers concerned in funding dwelling loans if mortgage charges are to return down rather more than they have already got, Fitch analysts warned.

TAKE THE INMAN INTEL INDEX SURVEY FOR SEPTEMBER

“Housing demand, as measured by houses offered above record worth and the common sale-to-list worth, has softened since August 2023 however stays above long-term averages,” Fitch analysts stated. “An extra decline in mortgage charges will assist enhance affordability and assist demand, however low stock will seemingly constrain dwelling gross sales till charges transfer nearer to five p.c.”

For these conserving shut tabs on mortgage charges, this week’s extremely anticipated Fed charge lower may need appeared anticlimactic.

After the central financial institution introduced short-term rates of interest down for the primary time in 4 years — beginning out what’s anticipated to be a protracted rate-cutting marketing campaign with a dramatic 50 basis-point lower — charges for FHA and conforming mortgages truly went up a bit Wednesday.

One motive mortgage charges went up is that Fed policymakers had been telegraphing their intention to chop charges for months. Since hitting a 2024 excessive in April, charges on 30-year fixed-rate conforming mortgage charges had already come down by greater than a share level this summer time.

The monetary policy tools on the Fed’s disposal permit it to make exact changes to short-term rates of interest, conserving the federal funds charge inside 1 / 4 share level of policymakers’ desired goal.

However the central financial institution doesn’t have direct management over long-term rates of interest like Treasury yields and mortgages, that are decided largely by supply and demand. If buyers — who weigh elements together with inflation expectations, financial development and financial coverage — resolve that it will be sensible to purchase authorities bonds and mortgage-backed securities, that may push long-term rates of interest down.

When Fed Chair Jerome Powell was requested Wednesday how a lot he thought mortgage charges may drop over the following 12 months, he steered that he was the improper individual to ask.

Powell’s press convention

“It’s very onerous for me to say,” Powell instructed Elizabeth Schulze of ABC Information. “From our standpoint, I can’t actually communicate to mortgage charges. I’ll say … that’ll rely on how the financial system evolves.”

Powell pointed Schulze to the Fed’s newest Summary of Economic Projections (SEP), which reveals what Federal Reserve Board members and Federal Reserve Financial institution presidents count on to occur with development, unemployment and inflation within the months and years forward — and the way they suppose short-term rates of interest may have to be adjusted.

To battle inflation through the pandemic, Fed policymakers raised the federal funds rate 11 instances between March 2022 and July 2023, bringing it to a goal of between 5.25 and 5.5 p.c — the best stage since 2001. Wednesday’s lower dropped the goal to 4.75 to five p.c.

The “SEP” — and its related “dot plot” — present that the median expectation of Fed policymakers is that by the tip of subsequent 12 months, the federal funds charge might be about 2 p.c decrease than it was earlier than Wednesday’s charge lower.

“If issues work out based on that forecast, different charges within the financial system will come down as effectively,” Powell stated. “Nevertheless, the speed at which these issues occur will actually rely on how the financial system performs. We are able to’t look a 12 months forward and know what the financial system’s going to be doing.”

Fed lower priced in to mortgage charges

Price-lock knowledge tracked by Optimal Blue reveals that charges on 30-year fixed-rate conforming mortgages hit a brand new 2024 low of 6.03 p.c Tuesday, however bounced again 5 foundation factors after Wednesday’s Fed assembly.

A weekly survey of lenders by the Mortgage Bankers Affiliation confirmed purposes for buy loans had been up by a seasonally adjusted 5 p.c final week when in comparison with week earlier than, however barely decrease (0.4 p.c) than a 12 months in the past. Requests to refinance had been up 24 p.c week over week and 127 p.c from a 12 months in the past.

Demand for typical buy mortgages assembly Fannie Mae and Freddie Mac’s necessities is up from a 12 months in the past, as homebuyers are seeing bettering affordability circumstances, sparked by decrease charges and slower home-price development, MBA Deputy Chief Economist Joel Kan stated, in a statement.

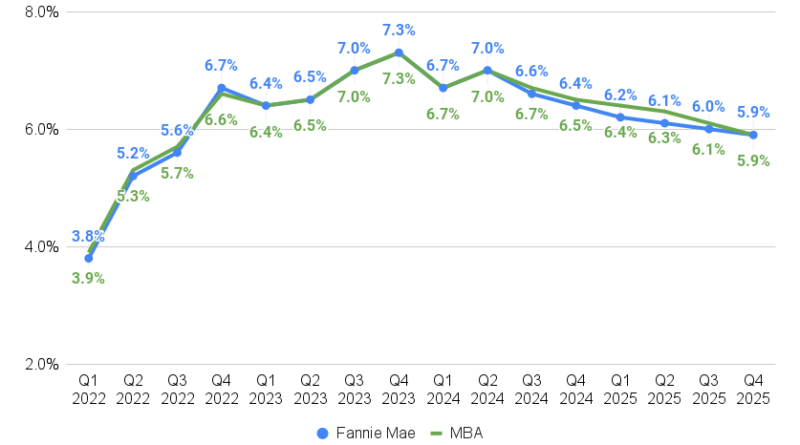

Charges on conforming mortgages have already come down greater than a full share level from a 2024 excessive of seven.27 p.c registered April 25 — almost to the place economists at Fannie Mae and the Mortgage Bankers Affiliation (MBA) forecast in August they might be on the finish of subsequent 12 months.

Mortgage charge forecast

Supply: Fannie Mae and Mortgage Bankers Affiliation forecasts, August 2024.

Taking a good longer view, analysts at Fitch Scores stated Thursday they count on 10-year Treasury yields, a barometer for mortgage charges, to nonetheless be at 3.5 p.c on the finish of 2026 — only a quarter share level decrease than Thursday’s shut of three.74 p.c.

To ensure that mortgage charges to return down extra dramatically, the “unfold” between 10-year Treasurys and 30-year mortgage charges might want to come down, Fitch analysts stated.

The 30-10 spread — which Fitch calculates averaged 1.8 share factors through the decade earlier than the pandemic — widened to three p.c at times last year.

Fed trimming its mortgage holdings

Traders have been demanding increased returns on mortgage-backed securities (MBS) on account of “prepayment danger” — the worry that debtors who take out loans when mortgage charges are elevated will refinance them once they drop.

Along with prepayment danger, demand for MBS has weakened because the Fed trims its huge holdings of MBS and authorities debt — a course of often called “quantitative tightening.”

As mortgage charges come down, so does prepayment danger. Fitch analysts suppose mortgage charges say the 30-10 unfold has already narrowed to 2.6 share factors this 12 months, however that development will in all probability must proceed to assist get mortgage charges beneath 6 p.c.

If the 10-year Treasury yield drops to three.5 p.c and the 30-10 unfold returns to 1.8 share factors, that might translate into 5.2 p.c mortgage charges, Fitch analysts stated.

In releasing their newest financial and housing forecasts in August, economists at Fannie Mae stated it should take time for falling charges to translate into gross sales.

A part of the issue is that along with making houses much less inexpensive to consumers, elevated mortgage charges have created a “lock-in impact” for would-be sellers who’re reluctant to surrender the low charge on their present mortgage.

Requested whether or not decrease mortgage charges may reignite demand for housing and push costs up, Powell stated decrease charges must also assist generate extra provide, by assuaging the lock-in impact and bringing extra listings onto the market.

“The housing market is partially frozen due to lock-in with low charges,” Powell stated. “Individuals don’t wish to promote their houses as a result of they’ve a really low mortgage [rate and] it will be fairly costly to refinance. As charges come down individuals will begin to transfer extra, and that’s in all probability starting to occur already.”

When that occurs, “You’ve acquired a vendor, however you’ve additionally acquired a brand new purchaser in lots of instances,” Powell stated. “So it’s not apparent how a lot further demand that might make.”

Get Inman’s Mortgage Brief Newsletter delivered proper to your inbox. A weekly roundup of all the most important information on the earth of mortgages and closings delivered each Wednesday. Click here to subscribe.