Synergy One Buying Montana-Based mostly Nationwide Lender Mann Mortgage

Whether or not it’s refining your enterprise mannequin, mastering new applied sciences, or discovering methods to capitalize on the subsequent market surge, Inman Connect New York will put together you to take daring steps ahead. The Subsequent Chapter is about to start. Be a part of it. Join us and 1000’s of actual property leaders Jan. 22-24, 2025.

Mann Mortgage, a Montana-based lender that did enterprise nationwide, is being acquired by Synergy One Lending — the San Diego-based lender’s second huge transfer this 12 months.

Synergy One onboarded a couple of dozen Draper and Kramer Mortgage Company branches that didn’t need to acquired by New American Funding in February, Synergy One Lending CEO Steve Majerus instructed Inman.

Majerus mentioned Monday that Synergy One expects to deliver on 140 to 150 Mann Mortgage workers, most of them mortgage originators, when the deal is wrapped up “in a day or two.”

Whereas Synergy One already has a presence within the Pacific Northwest, buying Mann Mortgage will add market share, Majerus mentioned. The businesses had been a great match as a result of each make use of the distributed retail mannequin and use comparable know-how.

Together with the Mann Mortgage acquisition, Synergy One has grown by 65 to 70 % this 12 months, Majerus mentioned — and remains to be on the hunt for offers.

“We consider that corporations are going to proceed to be challenged by a low origination atmosphere, and we proceed to search for alternatives the place we are able to add scale to our infrasctructure and deploy our know-how on the level of sale,” Majerus mentioned.

Whereas data present some Mann Mortgage workers have already jumped ship to Synergy One, others will apparently be searching for work.

“Fairly a number of are coming with us,” Mann Mortgage CEO Jason Mann told the Day by day Inter Lake, the native newspaper within the firm’s hometown of Kalispell. “Sadly, once you do a merger, we’re not capable of have everybody include us.”

Mann Mortgage didn’t reply to Inman’s requests for remark.

TAKE THE INMAN INTEL INDEX SURVEY FOR SEPTEMBER

San Diego-based Synergy One is licensed in 49 states (in every single place however New York) and Washington, D.C., sponsoring 348 mortgage originators who work out of 57 department areas, in line with records maintained by the Nationwide Multistate Licensing System (NMLS).

NMLS data present that some mortgage originators beforehand sponsored by Mann Mortgage made the transfer to Synergy One final week.

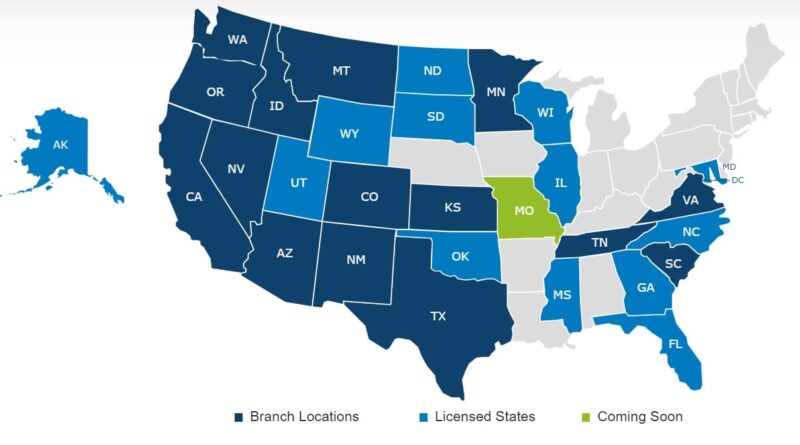

Mann Mortgage markets served

Supply: Mann Mortgage website, Oct. 1 2024.

Based mostly in northwest Montana not removed from Glacier Nationwide Park, Mann Mortgage is licensed and operates branches in states all through the West and Southeast — and has tangled with regulators in Idaho and Washington lately.

Mann instructed the Day by day Inter Lake that the final two years have been difficult for the mortgage trade as a complete, with increased mortgage charges crimping each dwelling gross sales and refinancings. He mentioned “becoming a member of forces with a staff that’s twice our measurement” will give the corporate a aggressive benefit, with native places of work persevering with to function as Mann Mortgage powered by Synergy One Lending.

Settlements with Idaho, Washington regulators

Whereas the post-pandemic period of excessive mortgage charges and residential costs has confirmed difficult for a lot of mortgage lenders, Mann Mortgage closed a department in Idaho and fired all of its staff after it attracted the attention of regulators greater than a decade in the past.

In 2017, Mann Mortgage agreed to pay $150,000 to Idaho regulators after examinations carried out in 2012, 2015 and 2016 allegedly uncovered situations during which the corporate’s mortgage documentation, enterprise administration, promoting and mortgage originator licensing did not adjust to state and federal legal guidelines.

In 2016, examiners with the Idaho Division of Finance mentioned they uncovered 20 separate mortgage transactions during which a department supervisor despatched emails to an appraiser telling him what the worth of the property wanted to be to ensure that the mortgage to be permitted.

Examiners additionally alleged that a number of workers on the identical department obtained reward playing cards from a house insurance coverage supplier that they referred mortgage candidates to, and uncovered proof that some workers carried out “licensable mortgage actions” earlier than they’d obtained the required licenses.

In keeping with the consent order, Mann Mortgage had beforehand been knowledgeable in regards to the department supervisor accused of “unlawfully speaking with an appraiser in regards to the appraisal course of.” Though the corporate mentioned the matter with the department supervisor it “didn’t implement procedures to stop the identical violation from occurring once more,” investigators claimed.

After the 2016 examination uncovered 258 problematic e mail communications between the department supervisor and the appraiser, Mann Mortgage shut down the department and fired all of its workers — together with the supervisor.

Idaho regulators mentioned Mann Mortgage had “began the method of enhancing its inner compliances” earlier than the 2016 examination, after which “it accelerated its efforts” to implement procedures guaranteeing it was in compliance, together with:

- Adopting an appraisal independence coverage

- Hiring a director of danger administration, and growing the compliance division from seven workers to 16

- Hiring an inner auditor to conduct on-site department audits, testing and setting controls

Three years after coming into into the consent order with Idaho regulators, Mann Mortgage paid $80,986 to authorities in Washington state to settle alleged compliance points at its Bellevue department.

Investigators with the Washington Division of Monetary Establishments claimed that Mann Mortgage failed to guard purchasers’ personally identifiable info (PPI) on the department, which was saved in software program functions, together with Salesforce and Quip, that the primary workplace didn’t have entry to. Investigators mentioned additionally they recognized situations during which the workers originated loans from unlicensed areas, failed to offer full and correct charge lock agreements, or didn’t present debtors with correct closing disclosures.

Mann Mortgage neither admitted nor denied any wrongdoing, however agreed to conduct on-site inner audits of all of its Washington branches and pay $40,986 to cowl the price of the investigation prompted by the 2016 and 2019 examinations.

The corporate additionally agreed to pay $40,000 to regulators “for functions of economic literacy and training,” with the consent order stipulating that the cost wouldn’t be marketed or publicized.

Editor’s observe: This story has been up to date with perspective from Synergy One Lending CEO Steve Majerus

Get Inman’s Mortgage Brief Newsletter delivered proper to your inbox. A weekly roundup of all the most important information on the planet of mortgages and closings delivered each Wednesday. Click here to subscribe.