RE/MAX Agent Depend Drops As Income Falls For Eighth Straight Quarter

Franchisor reported its U.S. agent rely fell 6.3 % in the course of the second quarter as income fell 4.8 % in comparison with a yr earlier, in keeping with its earnings report.

Inman Join is shifting from Las Vegas to San Diego in 2025 and it’ll be larger, higher and bolder than ever earlier than. Be a part of us for Inman Connect San Diego on July 30-Aug. 1, 2025 with the brightest minds in actual property to form the way forward for the trade. Reserve your spot today for an exclusive discount.

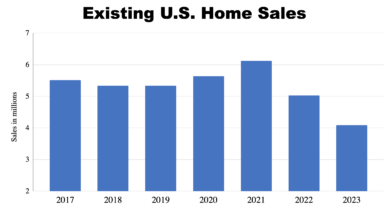

RE/MAX introduced on Thursday that its income has fallen every quarter for the previous two years because the down market continued to chop into the corporate’s earnings and agent rely.

The franchisor reported dropping slightly below 1,000 brokers within the second quarter of this yr, dropping 0.7 % to 143,542 brokers. In North America, the drop was even steeper as RE/MAX reported dropping 4.4 % of its brokers within the U.S. and Canada, the place it had 78,599 brokers to begin the third quarter.

Income fell 4.8 % in comparison with a yr earlier, the franchisor reported, and it expects it to maintain falling.

In an announcement, RE/MAX Holdings CEO Erik Carlson known as the second quarter outcomes “higher than anticipated.”

“We proceed to function our enterprise as effectively and successfully as attainable, which contributed to better-than-expected second-quarter monetary outcomes,” Carlson stated. “Each throughout and after the quarter, we had been happy to announce notable brokerage and group conversions to RE/MAX, testomony to our model’s robust fame and worth proposition out there.”

The corporate reported incomes $3.7 million in revenue for the quarter, in keeping with its earnings report.

Agent rely fell sharpest within the U.S. in the course of the quarter, dropping by 6.3 % to 53,406, RE/MAX reported. It grew by 4.2 % exterior the U.S. and Canada, to 64,943. At finest, the corporate stated it expects to lose none of its brokers subsequent quarter. At worst, it stated it’s anticipating dropping as much as 1.5 % of its brokers.

Total, the corporate generated $78.5 million in income in the course of the second quarter, which was down $4 million from a yr earlier.

The corporate has been aggressively shifting to regulate its bills on the identical time it has watched income drop. It reported reducing 10.1 % of bills within the quarter in comparison with a yr earlier.

As of June 30, the corporate reported having $66.1 million in money and money equivalents, down $16.6 million from December 2023. RE/MAX has $442.7 million in excellent debt, down barely from the tip of final yr.

RE/MAX stated it expects to tug in between $75 million and $80 million subsequent quarter. That might signify a drop between 1.5 % to eight.3 % in comparison with the third quarter of 2023.

RE/MAX is about to carry a name with traders on Friday morning.