Quantity Of $1M Properties In US Hits Document Excessive: Redfin

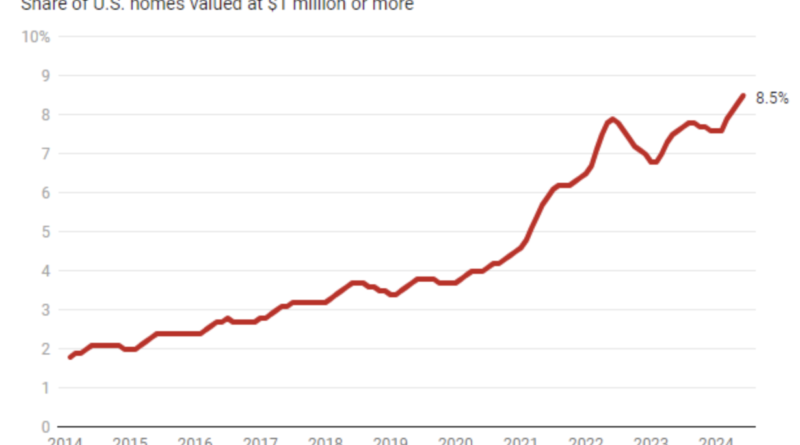

A file 8.5 p.c of all U.S. properties are price $1 million or extra, up from 7.6 p.c final 12 months and 4 p.c earlier than the pandemic, in keeping with a brand new Redfin evaluation. California is including them quicker than different states.

Whether or not it’s refining what you are promoting mannequin, mastering new applied sciences, or discovering methods to capitalize on the subsequent market surge, Inman Connect New York will put together you to take daring steps ahead. The Subsequent Chapter is about to start. Be a part of it. Join us and 1000’s of actual property leaders Jan. 22-24, 2025.

In some markets, a $1 million home is taken into account a luxurious property — however the variety of locations during which that also holds true is shrinking on a regular basis.

The variety of properties within the U.S. with an estimated worth of $1 million or extra has hit a brand new excessive, with 8.5 p.c of all properties hitting that worth, in keeping with information from Redfin offered to The Wall Street Journal.

Final 12 months, the share of $1 million properties within the U.S. was 7.6 p.c. Earlier than the pandemic, it was simply 4 p.c.

Extra properties are commanding that once-lofty value as house costs have soared nationally. The median house sale value was up 4 p.c 12 months over 12 months in June to a file $442,525, in keeping with Redfin. In the meantime, the median sale value for luxurious properties, or the highest 5 p.c of the market, elevated 9 p.c 12 months over 12 months to a file $1.18 million through the second quarter of 2024.

“Years in the past, if you happen to owned a $1 million house, you’d have been thought of fairly wealthy,” Redfin economist Chen Zhao instructed The WSJ. “Now, that’s the entry level for some markets.”

Though homebuying demand has softened in latest quarters due to excessive mortgage charges, costs proceed to rise resulting from low stock, which is driving competitors, Redfin’s report said. Stock has grown in latest months, however continues to be roughly 30 p.c decrease than pre-pandemic ranges.

The rising share of $1 million properties within the U.S. is an efficient factor for householders and sellers because it means rising fairness of their portfolio, however it provides to affordability challenges for homebuyers, particularly these buying their first house.

“Residence costs, insurance coverage and mortgage charges have shot up a lot that many individuals are both priced out of the market or weary of committing to such a excessive month-to-month cost,” stated Redfin Premier agent Julie Zubiate, who’s positioned within the Bay Space.

“The people who find themselves shopping for with out hesitation are in tech and work at Google, Apple, Fb or the same firm. Many Bay Space patrons — particularly these with out tech cash — are getting extra selective, leaping ship if a small drawback comes up in say, the inspection. They’re spending an excessive amount of cash to rationalize not getting every part on their must-have checklist.”

Recent drops in mortgage rates have helped patrons with affordability, growing their buying energy by tens of 1000’s of {dollars}, Redfin famous. That drop is bringing some patrons again into the market, Zubiate stated.

The share of $1 million properties can also be rising in most main metros throughout the U.S., aside from Austin, Texas, the place it declined by 0.1 p.c 12 months over 12 months and Indianapolis, Indiana, and Houston, Texas, the place the share of $1 million properties stayed flat on an annual foundation. In Texas, a push on new building has helped curb costs.

In the meantime, California, which already had the biggest share of properties valued at $1 million or extra, continues to realize them at a extra speedy clip than wherever else within the nation.

Anaheim noticed the best enhance in $1 million properties 12 months over 12 months, with 58.8 p.c of house hitting that threshold, up from 51 p.c one 12 months in the past. Subsequent, San Diego (42.6 p.c up from 36.5 p.c) and LA (39.3 p.c up from 35 p.c) noticed the best annual features in $1 million properties 12 months over 12 months. In these markets, the median house value was already round $1 million, which meant that many properties had been poised to hit or surpass that mark.

The Golden State additionally has the metros with probably the most $1 million properties — in San Francisco and San Jose, about 80 p.c of properties are price no less than $1 million, and in Anaheim, 58.8 p.c command no less than seven figures.

Nonetheless, there are nonetheless just a few metros on the market that hardly have any $1 million properties, together with Detroit, Cleveland, Pittsburgh and Kansas Metropolis, Missouri.

Get Inman’s Luxury Lens Newsletter delivered proper to your inbox. A weekly deep dive into the largest information on this planet of high-end actual property delivered each Friday. Click here to subscribe.