Novo Nordisk dad or mum to purchase Catalent to develop Wegovy provide

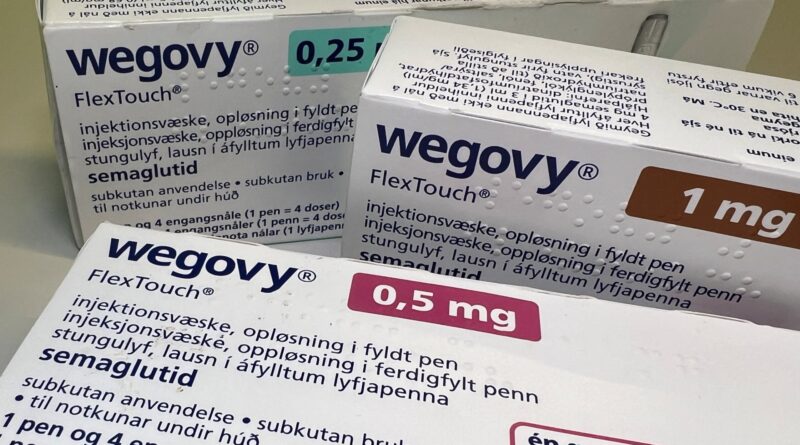

Bins of Novo Nordisk’s weight-loss drug Wegovy in Oslo, Norway, Nov. 21, 2023.

Victoria Klesty | Reuters

Danish drugmaker Novo Nordisk‘s dad or mum firm, Novo Holdings, on Monday mentioned it can acquire drug producer Catalent in a $16.5 billion deal that might assist boost the supply of the extremely in style weight reduction injection Wegovy and diabetes shot Ozempic.

Catalent is the principle provider of fill-finish work, which entails filling and packaging syringes and injection pens, for Novo Nordisk’s Wegovy.

Novo Nordisk will then purchase three of Catalent’s manufacturing websites from Novo Holdings for $11 billion. Novo Holdings owns virtually 77% of the voting shares in Novo Nordisk.

Novo Nordisk and Novo Holdings mentioned they anticipate the acquisition of the crops and the broader deal to purchase Catalent to shut on the finish of 2024.

Novo Nordisk added that it expects its buy to regularly assist enhance its filling capability starting in 2026. The corporate already contracts the three crops, that are situated in Italy, Belgium and Bloomington, Indiana.

Catalent shares rose about 10% in premarket buying and selling Monday after the deal announcement. The corporate has a market worth of roughly $10 billion. Novo Nordisk’s inventory rose virtually 2% in premarket buying and selling, for a market worth of about $390 billion.

Shares of Novo Nordisk jumped virtually 53% final yr as Wegovy and Ozempic soared in reputation — and slipped into shortages — for his or her potential to assist sufferers lose vital weight over time.

The Catalent deal is the corporate’s newest effort to spice up manufacturing capability for its medicine because it faces competitors from Eli Lilly and different rising rivals within the weight reduction drug market.

Final yr, the corporate introduced plans to spend money on new manufacturing amenities in Denmark and France. Novo Nordisk additionally mentioned final week that it has greater than doubled the variety of Wegovy starter doses it is transport to the U.S., which permits extra sufferers to start the therapy.

Below the phrases of the deal, Novo Holdings will purchase Catalent for $63.50 a share in money, a premium of 16.5% to Catalent’s closing worth on Friday.

The deal to purchase Catalent has the backing of activist investor Elliott Funding Administration, which has a stake within the U.S. firm, in accordance with Novo Holdings.

Notably, a few of Catalent’s factories that manufacture Wegovy have been linked to regulatory issues previously. Reuters reported in July that Catalent’s manufacturing unit in Brussels that fills Wegovy pens had repeatedly breached U.S. sterile-safety guidelines in recent times and that employees had did not carry out required high quality checks.

Do not miss these tales from CNBC PRO: