Newest Inflation Numbers May Give Mortgage Charges Extra Raise

Whether or not it’s refining your small business mannequin, mastering new applied sciences, or discovering methods to capitalize on the following market surge, Inman Connect New York will put together you to take daring steps ahead. The Subsequent Chapter is about to start. Be a part of it. Join us and hundreds of actual property leaders Jan. 22-24, 2025.

A key barometer for mortgage charges edged up Thursday as bond market traders digested blended indicators on the economic system, with the Client Worth Index exhibiting costs rose extra sharply in September than anticipated however unemployment claims surging final week to the best degree in additional than a 12 months.

Yields on 10-year Treasury notes, which regularly point out the place mortgage charges are headed subsequent, climbed 5 foundation factors Thursday, persevering with a development that’s introduced mortgage charges up by almost half a share level within the final three weeks.

The newest Client Worth Index (CPI) reading confirmed that after adjusting for seasonal elements, costs for items and companies elevated by 0.2 % from August to September. That’s the identical month-to-month enhance as in August and July, however about twice what economists had forecast. Rising prices for shelter, auto insurance coverage, medical care, attire, and airline fares drove the rise.

‘All objects’ CPI at lowest degree since February 2021

Annual inflation as measured by the “all objects” CPI dropped to 2.44 %, the bottom studying since February 2021 — largely as a result of a 6.8 % drop within the value of power and power companies. Whereas electrical energy value 3.7 % extra in September than a 12 months in the past, gasoline costs have been down 15.3 %.

Core CPI, which excludes unstable meals and power costs, was primarily unchanged from September, with costs up 3.26 % from a 12 months in the past.

That’s a good distance from the Federal Reserve’s 2 % inflation purpose, though the Fed uses a different yardstick — the Private Consumption Expenditures (PCE) index — to measure inflation.

Since hitting a post-pandemic peak of seven.25 % in June 2022, annual inflation as measured by the PCE index has come down by 5 share factors, to 2.24 percent in August.

The PCE index for September, which is derived from CPI and Producer Worth Index (PPI) information set to be released Friday, gained’t be printed till Oct. 31.

Sam Williamson

“Though September CPI got here in hotter than anticipated, with core CPI significantly stunning to the upside, labor market information stays essential for the Fed, possible making subsequent month’s payroll information key to figuring out the tempo and extent of additional Fed easing,” First American Senior Economist Sam Williamson stated, in an announcement.

The newest CPI information “possible reduces the probabilities of a Fed fee minimize in November, although a 25-basis level minimize stays the baseline expectation,” Williamson stated. “Friday’s PPI launch will provide additional readability.”

The CME FedWatch tool, which tracks futures markets to foretell the percentages of future Fed strikes, on Thursday put the percentages of a 25-basis level fee minimize in November at 82 %. However traders now see an 18 % likelihood that the Fed will go away short-term charges the place they’re.

Jobless claims up 15 %

Preliminary jobless claims surged 15 % in the course of the week ending Oct. 5 when in comparison with the week earlier than, to 258,000 — the best degree since August, 2023, the Division of Labor reported.

The surge “will be principally put all the way down to disruption brought on by Hurricane Helene, which made landfall late on September 26,” and ongoing strikes at Boeing “have most likely performed a job too,” Pantheon Macroeconomics Senior U.S. Economist Oliver Allen stated in a be aware to shoppers.

Claims “normally peak per week or two after the Hurricane makes landfall,” Allen stated, however because the influence of Helene begins to fade, the impacts of Hurricane Milton will begin to be felt.

Oliver Allen

“Our base case is that preliminary claims peak within the week ending Oct. 19 earlier than progressively returning to a extra ‘regular’ degree by mid-to-late November,” Allen stated.

Though preliminary jobless claims may surge above 300,000 within the subsequent couple weeks, “the Fed will most likely look by the labor market disruptions as a result of storm,” Allen predicted. “Hurricane Kartrina had little or no bearing on the [Federal Reserve’s] tightening cycle in 2005, for instance.”

Mortgage charges have been on the rise since Sept. 18, when the Fed accepted a 50 basis-point reduction within the short-term federal funds fee.

Traders who fund most mortgage loans had already priced in that minimize, and took be aware that the up to date “dot plot” launched by Fed policymakers confirmed they anticipate to deliver charges down extra slowly at future conferences to make sure that inflation continues to chill.

An Oct. 4 jobs report fueled the bounce in mortgage charges, exhibiting employers added 254,000 employees to their payrolls in September — and that unemployment declined for the second month in a row, to 4.1 %.

Mortgage charges on the rebound

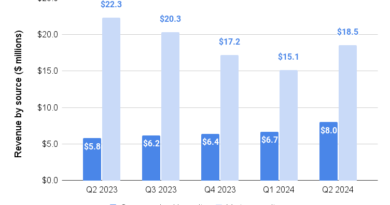

After hitting a 2024 excessive of seven.27 % on April 25, charges for 30-year fixed-rate loans and different forms of mortgages had been on the decline as bond market traders appeared forward to Fed fee cuts this 12 months and subsequent.

However since almost dropping beneath 6 % within the lead as much as final month’s Fed assembly, charges on 30-year fixed-rate mortgages have bounced again, averaging 6.42 % Wednesday, in accordance with rate-lock information tracked by Optimal Blue.

That’s up 39 foundation factors from the 2024 low of 6.03 % registered on Sept. 17, however not as painful for homebuyers because the post-pandemic excessive of seven.83 % registered in October 2023.

A month-to-month survey by mortgage big Fannie Mae confirmed client housing sentiment hit a 30-month high in September as mortgage charges have been dropping to 2024 lows, however greater than eight in 10 Individuals nonetheless stated it was a nasty time to purchase a house.

Get Inman’s Mortgage Brief Newsletter delivered proper to your inbox. A weekly roundup of all the largest information on the planet of mortgages and closings delivered each Wednesday. Click here to subscribe.