New credit score scores from FICO, VantageScore gaining traction

Mark your calendars for the last word actual property experiences with Inman’s upcoming occasions! Dive into the long run at Join Miami, immerse in luxurious at Luxurious Join, and converge with trade leaders at Inman Join Las Vegas. Uncover extra and be a part of the trade’s greatest at inman.com/events.

Someday within the not too distant future, Fannie Mae and Freddie Mac would require lenders to generate two credit score scores for debtors — the FICO Rating 10T and VantageScore 4.0 — if they need the mortgage giants to again their loans. Fannie and Freddie’s federal regulator plans to require lenders to start out utilizing each scores subsequent 12 months, though the timeline might slip.

Within the meantime, some mortgage lenders have already begun utilizing the brand new scores — that are stated to be extra correct and inclusive than variations of the FICO Rating required by Fannie and Freddie at present — when qualifying debtors for loans that they don’t intend to promote to the mortgage giants.

FICO (Truthful Isaac Corp.) announced Tuesday that Primis Mortgage Firm has grow to be the primary bank-owned mortgage originator to undertake the FICO Rating 10T to qualify debtors searching for non-conforming mortgages that don’t meet Fannie and Freddie’s underwriting necessities.

In January, FICO announced that CrossCountry Mortgage, the third largest retail mortgage lender, can be the primary firm to undertake the FICO Rating 10T to originate non-conforming loans (Motion Mortgage began utilizing the FICO Score 10T in October to research non-conforming mortgages along side traditional FICO Scores).

FICO claims that lenders utilizing the FICO Rating 10T can increase originations by as much as 5 % with out taking over extra credit score danger, or proceed the identical quantity of lending whereas decreasing default danger and losses by as much as 17 %.

Julie Might

“Through the use of FICO Rating 10T, Primis Mortgage will be capable to present debtors with entry to credit score whereas supporting the financial institution’s continued development and monetary inclusion initiatives,” stated FICO govt Julie May in a press release.

VantageScore, which is a three way partnership of the three nationwide credit score reporting businesses — Equifax, Experian and TransUnion — had information of its personal this week: the Federal House Mortgage Financial institution of San Francisco announced Monday it’s now accepting mortgages originated by lenders utilizing VantageScore 4.0 credit score scores as collateral.

As a result of VantageScore 4.0 considers rental funds and different knowledge factors not included in conventional scoring fashions, the financial institution says its members will be capable to assist shut the racial homeownership hole by originating extra loans to underserved debtors.

FHLBank San Francisco, which in 2021 launched the Racial Equity Accelerator for Homeownership with the City Institute, is the primary member of the Federal House Mortgage Financial institution System to simply accept mortgages originated by lenders utilizing the VantageScore 4.0 predictive scoring mannequin as collateral.

Teresa Bryce Bazemore

“Over the previous few years, now we have devoted important assets and dedication to investing in increasing Black homeownership and we’re excited to be the primary mover amongst our friends and convey this system to life,” stated FHLBank San Francisco President and CEO Teresa Bryce Bazemore in a press release.

Richard Wada, chief lending officer at Dublin, California-based Patelco Credit score Union, stated the credit score union has been utilizing VantageScore 4.0 to qualify debtors for auto loans and bank cards.

Richard Wada

VantageScore 4.0 has “offered us with a brand new pathway to offer honest and correct credit score scores to a broader inhabitants, creating alternatives for us to lend credit score safely and soundly to shoppers traditionally left behind,” Wada stated, in a press release. “We look ahead to leveraging VantageScore 4.0 for mortgage lending sooner or later.”

The form of issues to come back

It stays to be seen how lengthy it can earlier than lenders are required to make the change to FICO Rating 10T and VantageScore 4.0 — and likewise transfer to a “bi-merge” course of permitting lenders to submit two credit score studies as an alternative of three (“tri-merge”) when calculating credit score scores.

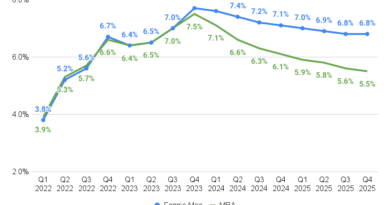

After validating the brand new credit score scores to be used by Fannie and Freddie in October 2022, the Federal Housing Finance Company (FHFA) final March revealed a phased timetable for implementation.

Below that timetable, lenders would nonetheless be allowed to base their underwriting choices on the Basic FICO credit score rating till the top of subsequent 12 months. However starting within the third quarter of this 12 months, lenders would even be anticipated to generate FICO Rating 10T and VantageScore 4.0 credit score scores when promoting loans to Fannie and Freddie.

Lenders complained that the schedule can be difficult to fulfill, so final fall the FHFA announced that it was searching for extra public enter, which left the timeline for implementation doubtful.

A proposed timeline revealed by Fannie and Freddie in December maintains a Q3 2024 objective for the primary section of the VantageScore 4.0 rollout, and This fall 2025 because the objective for remaining implementation. However there’s an asterisk on the backside of the timeline noting that facets “are topic to potential revisions sooner or later.”

VantageScore has engaged in a public relations campaign to maintain the This fall 2025 timeline for requiring lenders working with Fannie and Freddie to make use of VantageScore 4.0, saying delays would influence “creditworthy folks of coloration.”

Certainly one of VantageScore’s backers, the credit score reporting company TransUnion, has additionally questioned the plan to let lenders use two as an alternative of three credit score studies, claiming some borrowers will find yourself paying the next price or be declined for a mortgage altogether.

Get Inman’s Mortgage Brief Newsletter delivered proper to your inbox. A weekly roundup of all the most important information on this planet of mortgages and closings delivered each Wednesday. Click here to subscribe.