Nation’s Largest Mortgage Lender, UWM, Leaping On AI Bandwagon

Whether or not it’s refining what you are promoting mannequin, mastering new applied sciences, or discovering methods to capitalize on the subsequent market surge, Inman Connect New York will put together you to take daring steps ahead. The Subsequent Chapter is about to start. Be a part of it. Join us and hundreds of actual property leaders Jan. 22-24, 2025.

From lenders to mortgage servicers, the mortgage business is embracing AI, and the nation’s largest supplier of residence loans is not any exception — regardless that it’s a wholesaler that works with mortgage brokers and never immediately with shoppers.

Launched in Could, United Wholesale Mortgage’s ChatUWM is a “sensible search” software that helps mortgage brokers perceive lender pointers, matrices and instruments and applied sciences that UWM makes out there to brokers.

ChatUWM faucets into UWM’s data base, The Supply, pointing brokers to full articles or pages it’s pulling info from in order that they have extra context. UWM introduced new options on Wednesday that permit customers to question paperwork and discover mortgage choices for debtors primarily based on their monetary state of affairs.

“Brokers can now add any PDF and interact in dynamic conversations with the paperwork,” UWM mentioned in an announcement. “Whether or not extracting important particulars from an appraisal or clarifying vendor credit from a purchase order settlement, ChatUWM simplifies the method, enabling brokers to rapidly perceive key info.”

TAKE THE INMAN INTEL INDEX SURVEY FOR SEPTEMBER

ChatUWM relieves brokers of chores like calculating borrower revenue by permitting the software to extract the mandatory information and do the calculations after they add paperwork like W2s and self-employed revenue statements.

Armed with a credit score report and W2, ChatUWM may even analyze the paperwork, ask follow-up questions wanted to fill in any gaps, and suggest loans that might be good matches for the borrower — together with the dealer’s compensation for every possibility, UWM says.

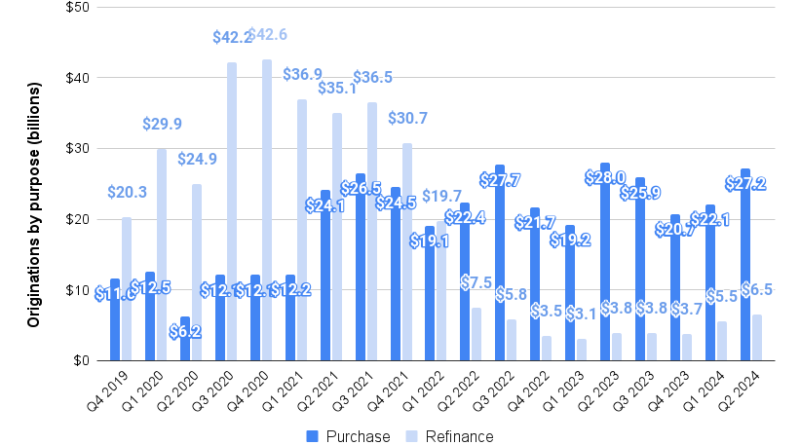

UWM’s pivot from refi to buy loans

Supply: UWM earnings reports.

With buy loans constituting 81 p.c of UWM’s Q2 2024 mortgage originations — greater than double the 40 p.c share registered throughout Q2 2021 — serving to mortgage brokers serve homebuyers is essential.

ChatUWM lets brokers add a purchase order settlement and ask, “What are the vendor credit?” and “Is the customer contributing something extra?”

However refinancing boomed when mortgage charges plummeted in the course of the pandemic, and on UWM’s Q2 earnings call in August, CEO Mat Ishbia mentioned he noticed refinancing as the most important fast alternative if mortgage charges continued to fall.

The Pontiac, Michigan-based wholesaler will put AI to work to develop that enterprise, too, having rolled out a brand new software final month that sends pre-validated refinance alerts to debtors who appear like they’d be capable of scale back their month-to-month funds.

“When a refi market hits, one of many greatest challenges mortgage originators face is staying in entrance of their previous purchasers and competing with the substantial budgets and aggressive advertising techniques of enormous banks and retail lenders,” UWM mentioned in announcing the brand new AI-powered KEEP software on Sept. 11.

In line with UWM, KEEP continually displays and validates borrower information factors on beforehand closed loans. When it identifies refi candidate, it robotically sends the home-owner an e-mail explaining what they could save by refinancing and offers a hyperlink to a mortgage utility.

Mat Ishbia

“KEEP’s proprietary expertise will create the simplest refi course of ever — offering alternative to the dealer and vital financial savings to the borrower,” Ishbia mentioned in an announcement. “It provides brokers the aggressive edge they want to reach this market and additional solidifies why the wholesale channel is the most effective place for shoppers to get a mortgage and mortgage originators to work.”

A lot of UWM’s rivals — together with Rocket Mortgage, which UWM surpassed in 2022 when the pandemic-fueled refi growth light — have additionally been scrambling to include AI into every little thing from advertising to processing and underwriting mortgage purposes and promoting the loans they originate.

Rocket, which has mentioned its investments in AI have cut turn times by 25 percent, says that when lending picks up once more, will probably be in a position to rapidly scale its business with out having to go on a hiring binge.

Residence fairness line of credit score (HELOC) supplier Determine says it’s developed a course of powered by OpenAI’s GPT that’s lower handbook upfront doc evaluation labor by 93 p.c whereas elevating buyer satisfaction scores.

Mortgage servicing large Mr. Cooper, which collects month-to-month funds on greater than $1 trillion in mortgages, spends a number of hundred million {dollars} a 12 months on name heart operations and expects a minimum of $50 million in annual financial savings from its funding in a multiyear AI project.

Whereas not all firms have the assets to develop AI instruments in-house, a rising variety of tech suppliers are providing to assist.

Mortgage tech supplier TidalWave’s AI-powered residential mortgage engine, SOLO, is now built-in with Fannie Mae’s Desktop Underwriter and Freddie Mac’s Loan Product Advisor.

Simplist Applied sciences presents Sonar, an AI-powered resolution integrating mortgage origination software program, level of sale software program, a product pricing engine (PPE) and buyer relationship administration.

Mortgage expertise supplier Maxwell presents an AI-powered business intelligence tool for lenders that permits them to make database queries in plain English.

Mortgage capital markets expertise supplier Polly is embedding AI inside its PPE, enabling instruments like an “interactive copilot for mortgage officers” the company says is able to processing, deciphering, and recommending “a variety of outcome-driven outcomes.”

Greater than FOMO

A June survey by clever automation firm ABBYY discovered that “FOMO” — the worry of lacking out — is a key driver of AI adoption.

In a breakout of the survey targeted extra tightly on the banking and monetary providers sector that ABBYY supplied to Inman, 69 p.c of IT decision-makers acknowledged that they worry being left behind in the event that they don’t undertake AI. Nevertheless, 64 p.c mentioned prospects count on it, and 63 p.c mentioned they’re AI as a strategy to improve their firm’s effectivity and supply customer support.

Two-thirds of IT resolution makers within the monetary providers sector (66 p.c) mentioned their firms are already utilizing generative AI instruments like ChatGPT, giant language fashions (LLMs), chatbots and digital assistants. Greater than half of firms within the sector (56 p.c) mentioned they have been utilizing purpose-built AI instruments resembling clever doc processing (IDP).

Maxime Vermeir

“It’s attention-grabbing to see the monetary providers sector’s religion in LLMs regardless of the preliminary skepticism in direction of their tendency to hallucinate or present inaccurate outcomes,” ABBYY government Maxime Vermeir mentioned, in an announcement. “This means that the market is maturing by incorporating purpose-built instruments like IDP into their AI technique, utilizing them to handle particular enterprise wants and allow extra belief in LLM-powered options.”

The survey additionally discovered that AI adoption charges diverse broadly amongst departments inside monetary providers firms:

- Finance administration (48 p.c)

- Advertising and marketing (46 p.c)

- Growth and engineering (46 p.c)

- Customer support (44 p.c)

- Gross sales (40 p.c)

- Operations (38 p.c)

- Procure to pay (31 p.c)

- Accounts payable (28 p.c)

The most important considerations about utilizing AI amongst IT decision-makers within the monetary providers sector have been the price of implementation and technical complexity (35 p.c), adopted by information necessities for coaching (34 p.c) and potential misuse by staff (33 p.c).

Whereas 82 p.c mentioned they trusted AI, the most important concern amongst those that didn’t was the reliability and accuracy of information (50 p.c), with 42 p.c citing worries about cybersecurity and information breaches, AI bias and information privateness.

Get Inman’s Mortgage Brief Newsletter delivered proper to your inbox. A weekly roundup of all the most important information on this planet of mortgages and closings delivered each Wednesday. Click here to subscribe.