Mother-And-Pop Flippers Make The Dream Of Homeownership A Actuality

Whether or not it’s refining your corporation mannequin, mastering new applied sciences, or discovering methods to capitalize on the following market surge, Inman Connect New York will put together you to take daring steps ahead. The Subsequent Chapter is about to start. Be a part of it. Join us and hundreds of actual property leaders Jan. 22-24, 2025.

Whereas the actual property business continues to wrestle with a present gross sales tempo of solely 3.95 million houses for 2024, do you know that actual property buyers are scooping up a further 1 million vacant and/or unlivable houses? Much more stunning, as much as 97 % of those buyers are mom-and-pop patrons. For savvy brokers and brokerages, this just about untapped market is usually a goldmine for your corporation.

New Western helps roughly 200,000 buyers in 42 main markets find potential flips and rehabs. Kurt Carlton, president of New Western, not too long ago joined me to share his firm’s newest analysis from their quarterly Flip Facet Report. Their findings upend a lot of what the business believes about as we speak’s actual property buyers.

Homeownership lays the muse for having a greater life

Carlton strongly believes that homeownership is the trail to becoming a member of the center class and constructing wealth.

“If we don’t have the chance for individuals like academics and nurses to buy houses, then we don’t actually have a lot upward momentum main into the center class. That may end up in a bunch of different issues we’re going to face if we don’t have reasonably priced stock, Carlton stated.

“When you take a look at the stock made out there by actual property buyers the place they discover a vacant house and return it to market, it’s a few of the most reasonably priced stock that’s available on the market. On common it’s 21 % extra reasonably priced that then median value for brand new houses.”

“When you consider the affordability band of those houses, these actual property buyers are actually attempting to guard homeownership by making extra stock out there for the aspiring home-owner.”

3 high takeaways from New Western’s newest Flip Facet Report analysis

In keeping with the New Western website, listed below are the highest three key takeaways from their newest Flip Facet Report analysis:

1. Native buyers are key gamers in housing stock

Impartial buyers, typically native and small enterprise house owners, proceed to considerably tackle the housing stock scarcity forward of institutional buyers and builders.

2. Demographic shifts amongst actual property buyers

The true property investing panorama is diversifying, with Gen Z and feminine buyers changing into extra outstanding.

3. Native buyers make a constructive influence on reasonably priced housing

Native buyers are a pivotal group in making housing extra reasonably priced by revitalizing uncared for properties and returning them to the market at cheaper price classes.

Buyers rehabbing homes are making a significant influence on the actual property market

Whereas NAR is reporting that we’re on monitor to promote about 3.95 million houses this yr, New Western’s analysis exhibits that mom-and-pop rehab and fix-and-flip buyers represent the majority of market transactions.

Carlton shared the next findings in our interview:

- Near 1 million houses will likely be bought by actual property buyers.

- Solely 28 % are bought via the MLS. Assuming 1 million funding gross sales, that interprets into roughly 720,000 houses are being bought by buyers outdoors the MLS.

- Rehab and fix-and-flip buyers are including to the housing stock, quite than decreasing it

In lots of instances, these properties have been vacant and infrequently unlivable.

“Many of the actual property neighborhood thinks about buyers buying off market properties as taking away from the stock, however what they’re doing is figuring out a number of this stock that’s vacant, that’s distressed, and truly making ready it to be listed on the MLS, contributing these further models,” Carlton stated. “As soon as these houses are fastened and livable, most of them are being listed on the market on the MLS.”

Immediately’s actual property buyers are usually not who you assume they’re

When you point out something about buyers buying single-family residences, most individuals roll their eyes as a result of they assume these gross sales are to institutional buyers.

That’s merely not the case primarily based on New Western’s knowledge.

From 2021 to 2024, notice the numerous decline within the variety of institutional gross sales:

- 2021: 17 %

- 2022: 14 %

- 2023: 8.5 %

- 2024: 2.8 % year-to-date

Carlton went on to clarify: “The overwhelming majority of those houses after they’re rehabbed are good, they’re fastened up, they’re livable, they usually’re being listed on the MLS.

“Institutional buyers have ceded the entire house again to unbiased, native actual property buyers, and that’s wonderful. Solely 2.8 % of the present transactions which can be rehabs and flippers are being completed by institutional buyers.”

‘The Nice Resignation’ is feeding the rehab and fix-and-flip markets

Carlton has been monitoring this knowledge for the previous three or 4 years, and right here’s what he found.

“We’ve had this Nice Resignation. Everyone’s left these 9-to-5 jobs, these company rat races. And so they’ve gone into these facet hustles, or no matter you wish to name it, and lots of people have come into the house,” Carlton stated.

“When you take a look at the buyers as we speak, you’ve acquired a number of these company refugees which have some cash within the financial institution, they’ve some administration experience from their profession, they usually’re transitioning from managing staff to managing contractors, they usually’re succeeding.”

The recent new date night time?

Carlton not too long ago got here to an interesting realization, largely as a consequence of his firm’s most up-to-date Flip Facet analysis knowledge.“It’s much less about operating a spreadsheet and attempting to eke out a return and extra about being concerned in the neighborhood. It’s a ardour mission.” Carlton stated.

“We see a number of husband-and-wife groups. They’re concerned in taking one thing, which just about at all times is these blighted vacant homes, and returning them to the market. For years they’ve seen this on tv, they usually now get to do it daily. So, it’s changing into a actuality the place you may make actual cash.”

So, what’s Carlton’s tackle the new new date night time for Zoomers and Boomers?

“Who would have thought that the new new date night time for each Zoomers and Boomers is rehabbing a home?”

The main rehab problem lurking forward

Carlton warned of an unlimited subject that has already began to influence the present itemizing stock.

“Over the last large builder increase main as much as Nice Recession in 2008, we constructed 25 % of the houses which have ever been in-built the USA. We constructed a number of these houses very quick, very low-cost, after which we stopped constructing houses.”

Since then, builders have been unable to maintain up with the rising demand.

“That’s why we’re on this affordability disaster. Individuals hold having youngsters, they need a house, however we didn’t ship the stock,” Carlton stated.

Carlton cited a number of examples of challenges brokers are already confronting in these 20- to 40-year-old houses that represent about 20 % of present stock.

- Concrete slabs with PVC pipe leaks the place the ground must be jack-hammered to switch the damaged pipe.

- 20- to 30-year-old roofs that may quickly have to get replaced.

- Boomers growing older in place, leading to vital quantities of deferred upkeep.

Fixer-uppers are too overwhelming for many brokers

Carlton then defined why these properties typically do poorly in the event that they’re posted to the MLS.

“The MLS is nice for conventional transactions. If you put an inventory that wants all the things on the MLS, each Realtor who has ever had listings understands that it’ll require an amazing quantity of effort and time and that everyone’s in all probability going to be sad on the finish of the day,” Carlton stated.

When these properties are valued underneath $150,000, the quantity of effort and time the itemizing agent will incur to shut the transaction is just not value it. Consequently, it’s not stunning these properties typically promote off-market to buyers.

The chance is immense

Carlton defined the huge measurement of this chance, particularly on condition that “there are 15 million vacant houses within the U.S., and there may be an awesome demand for housing.”

The majority of the homes which can be being rehabbed by New Western’s purchasers are within the considerably cheaper price ranges (as little as $80,000) versus $200,000, $400,000 or $600,000.

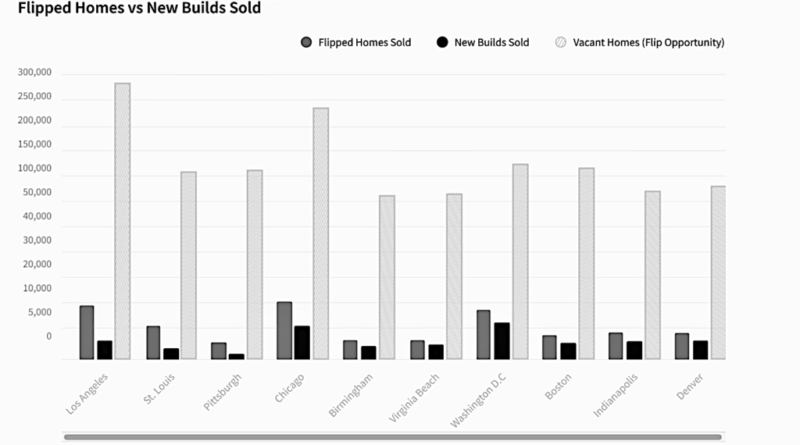

The next chart from the New Western web site illustrates the dimensions of this chance in 10 main markets throughout the U.S.

A ‘bombshell discovering’

Within the chart above, “Vacant houses (Flip Alternative)” dwarfs each “Flipped Properties Offered” and “New Builds Offered.”

What’s most stunning, nevertheless, is that in every of the ten markets cited above, the variety of “Flipped Properties Offered” additionally exceeded the variety of “New Builds Offered.” That is one thing we’ve by no means seen earlier than.

‘The proper storm’ for mom-and-pop buyers — brokers don’t need rehab listings

At famous above, solely 28 % of the roughly 1 million house gross sales to buyers in 2024 are from the MLS. What’s fascinating is what number of itemizing brokers have referred a rehab itemizing to New Western previously 12 months.

“I feel within the final 12 months, we’ve had 50,000 properties which have been delivered to us from itemizing brokers that simply stated, I don’t wish to record this. It is a value-add property,” Carlton stated.

It is a win-win for each the vendor and their agent because the rehab investor typically places these properties again on the MLS on the market, typically via the agent who made the referral within the first place.

Properties throughout a number of value ranges and infrequently positioned in higher places than new houses

Rehab and fix-and-flip buyers work in a number of value ranges relying upon the market in addition to upon how a lot they’re keen to spend on the rehab course of.

Most often, new houses are typically in undeveloped areas of a metropolis, versus prime places the place lots of the 20- to 40-year-old houses are presently positioned.

“Whereas builders are getting higher at it, they’re nonetheless not capable of ship reasonably priced houses, particularly within the neighborhoods and areas the place they’re actually wanted,” Carlton stated. “Many of the reasonably priced houses are being produced by builders the place land is reasonable and the demand actually isn’t there.”

Ladies rehabbers emerge as necessary gamers on this house

One of many sudden findings within the New Western analysis was that girls are a rising section of buyers.

“The unbiased feminine actual property investor section is beginning to develop, they usually’re outperforming the male section. They spend much less on their rehab, they’ve extra situations the place their house sells above market worth, and their houses promote quicker, “Carlton stated.

“It is sensible since females normally make the acquisition resolution in the case of the place to stay. If there’s a feminine designing all this for a feminine decision-maker, it ought to end in a greater, greater efficiency and the house ought to promote quicker and for extra.”

Zoomers are beginning to outperform their Boomer counterparts

Carlton stated their knowledge exhibits whereas Boomers are cautious, Zoomers transfer quick.

“Zoomers are a lot quicker due to what they will be taught on YouTube, the social media, and all these totally different methods on-line that apply to those houses,” Carlton stated.

“It was that you’d learn a e-book on the way to spend money on actual property, however by the point that e-book arrives from Amazon, the Zoomers have already discovered 12 alternative ways to take a position on this home, issues like ADUs, house hacking, different issues which can be occurring. They’re ready to have a look at the identical asset a Boomer would and infrequently outperform them on their ROI on these properties.

Actual property brokers are within the catbird seat

Actual property brokers who know their native market areas properly are uniquely positioned to identify vacant and run-down homes that could be nice targets to be rehabbed or flipped. As an alternative of strolling away from that run-down property that wants main work, perceive that buyers, rehabbers and flippers see these properties as golden alternatives.

Reap the benefits of it — it’s a win for you, the sellers, and the mom-and-pop buyers who’re serving to America flip the housing scarcity and affordability disaster round.

Bernice Ross, president and CEO of BrokerageUP and RealEstateCoach.com, and the founding father of RealEstateWealthForWomen.com is a nationwide speaker, creator and coach with over 1,500 printed articles.