Mortgage Charges Overtake Stock As Greatest Fear For Brokers: Triple-I

After exceeding 8 % in October, rising mortgage charges overtook “lack of housing stock” as the highest concern for actual property brokers, based on the outcomes of the most recent month-to-month Inman Intel Index.

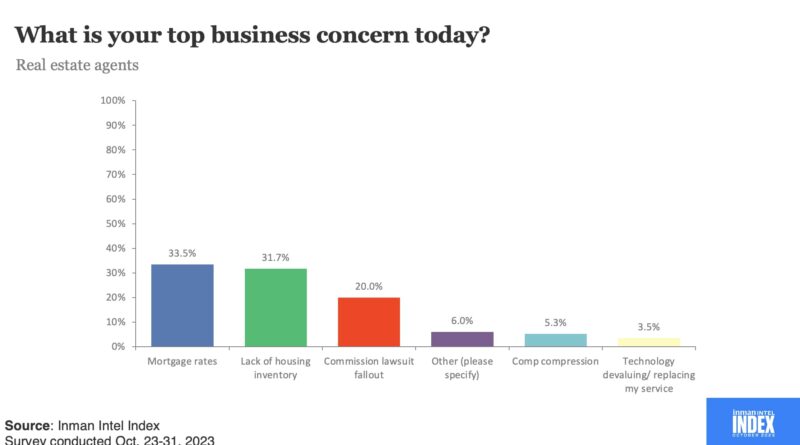

Roughly one-third of brokers and the brokerage executives who lead them imagine excessive mortgage charges are the largest for concern within the housing market at this time, surpassing low stock and fallout from fee lawsuits akin to Sitzer | Burnett, based on the outcomes of October’s Inman Intel Index survey, launched final week.

After exceeding 8 % in October, rising mortgage charges overtook “lack of housing stock” as brokers’ prime concern after rating second in the identical survey a month earlier. The findings are amongst a whole bunch gleaned from the Inman Intel Index, or Triple I, which was carried out Oct. 23-31 and drew 1,269 responses. The 168-page report is on the market completely to Inman Intel subscribers and features a complete breakdown of all survey responses.

This month’s Inman Intel Index survey is open now.

“I feel that homebuyers and actual property brokers perceive properly that the three % mortgage price is a historic abnormality and isn’t the norm,” Homosexual Cororaton, chief economist for the Miami Affiliation of Realtors, instructed Inman by e mail. “However the present price of 8 % can also be not regular, and I anticipate charges to go additional down in 2024.”

Mortgage charges have fallen considerably in November, with the common 30-year fastened mortgage nearer to 7 % than it has been in two months. For homebuyers and sellers, the profit is evident, however after greater than a yr of charges in extra of 6 %, the decline in charges can also be an enormous morale booster for actual property professionals, based on the survey outcomes.

Just one group surveyed within the Triple-I didn’t rank rates of interest as their prime enterprise concern in October. Mortgage originators, who did rank them first in September, put them second behind lack of house stock. With refinance exercise down severely, it stands to cause that brokers and bankers are targeted on houses coming available on the market.

To trace trade sentiment, the Triple-I polls actual property brokers, mortgage originators, brokers, trade executives and proptech leaders month-to-month. November’s survey opened at this time and might be accessed here.

Nobody will get a chew on the apple, although, till somebody decides to purchase a house, and elevated rates of interest proceed to issue closely into the homebuying equation for a lot of Individuals. A new consumer survey undertaken by Inman, in partnership with Dig Insights, surveyed 3,000 potential homebuyers and located that many must see a much more dramatic price drop to maneuver ahead.

Greater than 2 out of three Individuals surveyed by Dig Insights indicated they had been unlikely to purchase within the subsequent 12 months, and 35 % of these mentioned that prime rates of interest had been an element of their resolution. Requested how a lot mortgage charges would wish to lower for them to turn out to be seemingly to purchase, one-third selected “Greater than 2 %.”

In line with an Inman Intel analysis final month, a mortgage fee that will have been near $1,175 4 years in the past now involves over $2,600 a month. That’s an issue for lots of homebuyers, first-timers or not.

“With mortgage charges nonetheless anticipated to be elevated at over 5 %, there’s naturally the next monetary hurdle for current householders to maneuver,” wrote Cororaton, a former senior economist and the director of housing and business analysis on the Analysis Group of the Nationwide Affiliation of Realtors.

With a possible ceiling on charges, actual property brokers and mortgage originators are wanting towards 2024 with cautious optimism. Whereas almost 70 % of brokers indicated their purchaser pipeline was both lighter or considerably lighter than it was 12 months in the past, lower than 30 % felt that will be the case one yr from now. Over one-quarter of them responded “Heavier,” whereas slightly below 44 % mentioned they anticipated it to be about the identical.

Mortgage originators had been much more optimistic, with over 37 % anticipating a heavier borrower pipeline in 12 months.