Many Hoped A March Charge Minimize Would Increase Housing. Now, It is Not So Clear

Most actual property professionals consider charge cuts by the Fed will likely be essential for a gross sales restoration, in response to outcomes from the Inman Intel Index survey. However the timing on these cuts is hazy.

This report is on the market completely to subscribers of Inman Intel, the information and analysis arm of Inman, providing deep insights and market intelligence on the residential actual property and proptech companies. Subscribe today.

A unanimous opinion amongst actual property leaders is uncommon.

However in response to January’s Inman Intel Index, or Triple-I, actual property professionals have been practically in lockstep on one factor: a number of charge cuts by the Federal Reserve this 12 months will likely be a vital element of the housing market’s restoration.

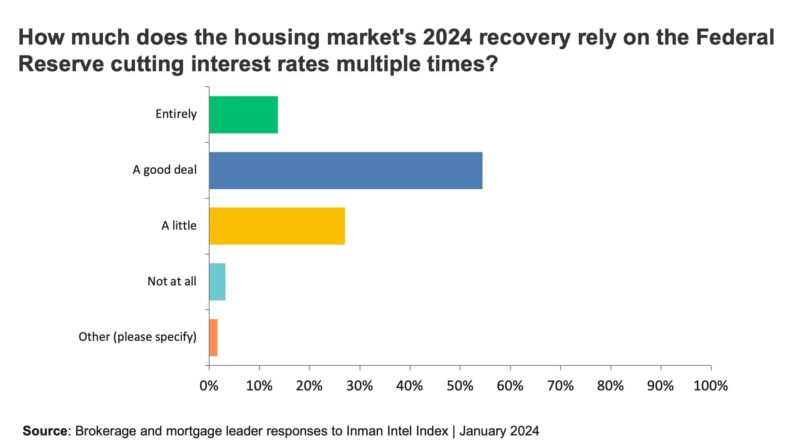

Greater than 96 p.c of brokerage and mortgage firm leaders who responded to the Triple-I in January agreed {that a} 2024 housing rebound relied at the least considerably on the Fed reducing charges a number of instances.

Amongst these leaders, 55 p.c believed “a great deal” of the restoration hinged on these cuts, and one other 14 p.c mentioned the restoration was “completely” contingent on them.

Chart by Chris LeBarton

It’s truthful to say, then, that it’s been a tough couple of weeks for these Federal Reserve watchers amongst a gaggle the place 60 p.c consider customers haven’t adjusted to or accepted mortgage charges within the vary of 6 p.c to 7 p.c.

TAKE THE FEBRUARY INMAN INTEL INDEX SURVEY NOW

Whereas most nonetheless anticipate the Fed to decrease its efficient federal funds at the least thrice this 12 months, the timing of these cuts has grown much less clear because the Triple-I closed on Jan. thirty first.

Right here’s why:

- On that very same day, Fed Chair Jerome Powell’s comments on the shut of the committee’s January assembly deflated a lot of the optimism that the Fed would reduce charges as quickly as its subsequent assembly in March.

- Two days later, the Labor Division launched one other unexpectedly robust jobs report that confirmed an unemployment charge of three.7 p.c. Unemployment has been under 4 p.c for the longest stretch in over 50 years.

- Hopes of a March charge reduce have been all however dashed at 8:30 a.m., Feb. 12. That’s when January’s Client Worth Index figures have been launched, and each the headline and core measures of inflation overshot market expectations.

These developments don’t assure the Fed holds its key rate of interest, at the moment between 5.25 p.c and 5.50 p.c, in place when it meets next month. However past the clear communication from Powell and little information left to vary the equation, a bullish Wall Avenue has modified its tune, too.

The CME Group’s FedWatch Tool, which tracks futures markets to foretell the Fed’s strikes, has proven a precipitous drop of investor perception in a March charge reduce. Final week, simply 10.5 p.c of traders anticipated the Fed to slash charges in March. That is down from 39 p.c instantly following the January assembly and a fraction of the 88 p.c studying on Dec. 29.

Brokers and mortgage officers in sync

The Triple-I gives month-to-month insights from brokers and lenders, too, and similarity emerged of their outlook on the significance of charge cuts to their companies.

- 2 out of three mortgage lenders rated a charge reduce by March at a 4 or 5 when it comes to significance, the place 1 was outlined as inconsequential and 5 represented important. This discovering comes amid the backdrop of a number of mortgage firm closures and consolidations, which have intensified because the begin of the 12 months.

- The share was solely barely much less for brokers: 60 p.c of them categorized a March charge reduce’s significance as a 4 or 5.

Mortgage charges ranked second on the checklist of enterprise considerations for each brokers and lenders.

Each teams nonetheless had the “lack of housing stock” sitting atop their respective lists, despite some recent momentum in the number of homes newly listed for sale. In a counter-intuitive method, charges not falling — and even rising, to a level — would assist with their shared woe. When charges improve, fewer patrons qualify for houses, resulting in stock progress.

So when will mortgage charges go down?

As a result of the Fed’s charge actions don’t straight transfer mortgage charges, it’s solely so useful to maintain trying into their magic ball.

However they do play a key function in influencing the markets, and coming into the again half of February, three cuts have been absolutely discounted in bond markets. A fourth reduce by December was priced at barely higher than 60 p.c odds.

What some market watchers are watching as a lot, if no more, is the prevailing unfold differential between the 10-year Treasury bond and 30-year fastened mortgage charge. This unfold — the typical charge of a 30-year fastened mortgage minus the 10-year U.S. Treasury yield — had been coming down off a two-decade excessive of two.9 p.c. Traditionally, the hole between the 2 measures is nearer to 170 foundation factors.

So long as charges on U.S. Treasuries keep elevated, mortgage charges will stay excessive, too. But when the yield unfold can compress once more and the Fed begins its spherical of cuts, charges are nonetheless able to finish nearer to six p.c than 7 p.c by the tip of 2024.

The one factor anybody appears to know, although, is that it’s unlikely to occur subsequent month.

Methodology notes: This month’s Inman Intel Index survey was carried out Jan. 21-31, 2024. Your entire Inman reader group was invited to take part, and Intel obtained a complete of 1,029 responses. Respondents for this survey have been directed to the SurveyMonkey platform, the place they self-identified their profiles inside the residential actual property market. Respondents have been restricted to at least one response per gadget, however there was no limitation to IP addresses. As soon as a profile (residential actual property agent, mortgage dealer/banker, company government/investor/proptech, or different) was chosen, respondents answered a novel set of questions for that particular profile. As a result of the survey didn’t request demographic data for age, gender, or geography, there was no information weighting. This survey will likely be carried out month-to-month, with each recurring and distinctive questions for every profile sort.