Low-Danger Actual Property Investing Methods

Title: My Journey into Low-Danger Actual Property Investing: Suggestions and Methods

Hey there, fellow buyers! At present, I wish to share my private journey into low-risk actual property investing and a few precious suggestions and techniques which have helped me alongside the way in which. Should you’re seeking to dip your toes into the world of actual property funding with out taking over an excessive amount of danger, then this text is for you.

Understanding the Fundamentals of Low-Danger Actual Property Investing

After I first began exploring actual property funding, I used to be overwhelmed by the myriad of choices accessible. From rental properties to fix-and-flip tasks, the probabilities appeared limitless. Nonetheless, I shortly realized that not all funding methods are created equal, particularly in terms of danger.

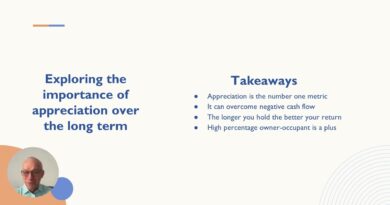

One of many first issues I realized was the significance of conducting thorough market analysis. Understanding the native actual property market traits, emptiness charges, and rental demand is essential in figuring out low-risk funding alternatives. This data helped me pinpoint areas with regular appreciation and rental earnings potential, minimizing the danger of economic loss.

Moreover, I delved into the world of passive actual property investing, equivalent to actual property funding trusts (REITs) and crowdfunding platforms. These avenues allowed me to diversify my funding portfolio with out the trouble of property administration, offering a low-risk various to conventional actual property possession.

Mitigating Danger via Due Diligence and Monetary Planning

As I continued my journey, I spotted the importance of due diligence in mitigating danger. Earlier than diving into any funding alternative, I made it a degree to completely examine the property, assess its situation, and conduct a complete monetary evaluation. This meticulous method helped me keep away from potential pitfalls and be certain that I used to be making knowledgeable funding choices.

Furthermore, I prioritized monetary planning and danger administration. By sustaining an emergency fund and securing sufficient insurance coverage protection, I safeguarded my investments in opposition to unexpected circumstances, equivalent to property injury or financial downturns. This proactive method supplied me with peace of thoughts and a buffer in opposition to potential monetary setbacks.

Exploring Low-Danger Actual Property Funding Methods

All through my actual property funding journey, I’ve come throughout a number of low-risk methods which have confirmed to be efficient. One such technique is investing in turnkey properties. These absolutely renovated and tenanted properties provide a hassle-free funding possibility, permitting me to generate passive earnings with minimal effort and danger.

One other technique that has labored effectively for me is investing in multifamily properties. The constant demand for rental housing and the power to unfold danger throughout a number of models have made multifamily properties a resilient and low-risk funding alternative. Moreover, I’ve discovered success in focusing on undervalued properties in up-and-coming neighborhoods, leveraging their potential for future appreciation whereas minimizing preliminary funding danger.

Remaining Ideas: Navigating the World of Low-Danger Actual Property Investing

As I mirror on my journey into low-risk actual property investing, I am unable to assist however emphasize the significance of training and strategic planning. By arming myself with data, conducting thorough due diligence, and exploring numerous funding avenues, I have been capable of construct a sturdy actual property funding portfolio whereas minimizing danger.

Should you’re contemplating venturing into actual property funding, I encourage you to discover low-risk methods and leverage the facility of knowledgeable decision-making. Keep in mind, the world of actual property funding is huge, however with the fitting method, you possibly can navigate it with confidence and obtain your monetary objectives.

So, there you may have it—my private insights and techniques for low-risk actual property investing. I hope you discovered this text useful and insightful as you embark by yourself funding journey. Here is to sensible and low-risk actual property investments!