LoanSnap’s Enterprise Dried Up. Now Regulators Are Coming For Its Licenses.

Whether or not it’s refining what you are promoting mannequin, mastering new applied sciences, or discovering methods to capitalize on the subsequent market surge, Inman Connect New York will put together you to take daring steps ahead. The Subsequent Chapter is about to start. Be a part of it. Join us and hundreds of actual property leaders Jan. 22-24, 2025.

LoanSnap, a fintech mortgage lender that launched in 2018 promising to assist customers use their residence fairness to repay high-interest debt, has had its license revoked in Connecticut and has been placed on discover by California regulators that they intend to do the identical.

The Costa Mesa, California-based lender — which raised tens of millions in enterprise capital from funds related to celebrities like Richard Branson, Joe Montana and LinkedIn co-founder Reid Hoffman — noticed most of its enterprise dry up final yr.

LoanSnap was evicted from its headquarters in Could and in addition faces lawsuits by collectors, in response to Connecticut regulators who issued a stop and desist order towards the corporate in January and suspended the corporate’s license within the state in July.

LoanSnap, which didn’t reply to requests for remark from Inman, entered right into a consent order with the Connecticut Division of Banking on Oct. 2.

Connecticut regulators alleged that the corporate employed name heart representatives who acted as unlicensed mortgage originators by taking mortgage purposes, providing or negotiating loans, and denying credit score to some debtors.

Though LoanSnap entered into the consent order “with out admitting or denying any allegations,” the corporate additionally agreed to not make any public assertion “denying, instantly or not directly, any allegation” or to “create the impression that [the] consent order is with out factual foundation.”

Driving the pandemic refi increase

After buying an current mortgage lender, DLJ Monetary, and launching in 2018, LoanSnap’s enterprise acquired off to a sluggish begin. The corporate originated simply 380 loans in 2019 totaling $131.7 million, in response to a Shopper Monetary Safety Bureau database.

However when mortgage charges plummeted to historic lows throughout the pandemic, LoanSnap’s enterprise took off. In 2020 and 2021, LoanSnap reported originating 2,164 loans totaling $822 million.

In announcing $10 million in enterprise funding in Could 2020, LoanSnap claimed to have invented “the world’s first good mortgage expertise that makes use of synthetic intelligence to investigate an individual’s funds and reveals easy methods to learn from a better mortgage.”

That spherical — co-led by True Ventures and MANTIS, the funding agency created by EDM-pop duo The Chainsmokers — adopted on the heels of a $30 million Series B, and former investments by Richard Branson’s Virgin Group and Joe Montana’s Liquid 2 ventures.

LoanSnap attracted high-profile traders

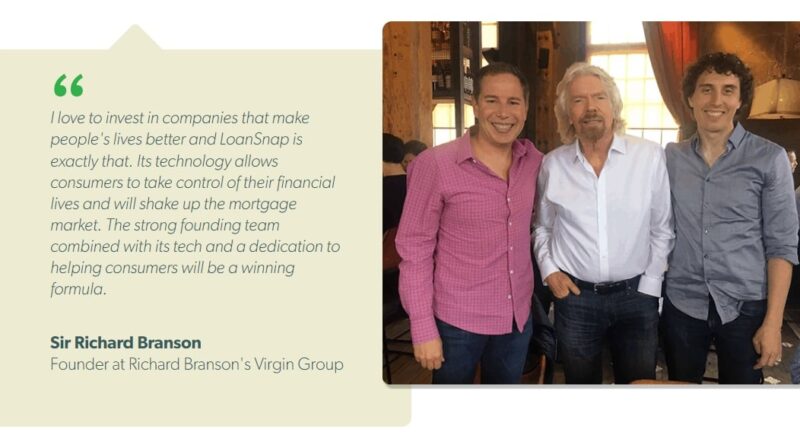

LoanSnap co-founder and CEO Karl Jacob, left, and co-founder and CTO Allan Carroll, proper, pose with backer Richard Branson. Supply: Screenshot of LoanSnap website.

Providing cash-out refinancing and residential fairness strains of credit score (HELOCs), LoanSnap inspired customers to consolidate high-interest fee debt right into a mortgage backed by their residence with a purpose to get a decrease fee.

“The rates of interest in your bank cards, pupil loans or automobile loans are doubtless a lot larger than the rate of interest in your mortgage,” LoanSnap continues to pitch customers on its website in the present day. “Most individuals don’t notice they’ll transfer their bank cards or loans to their mortgage and save hundreds in curiosity funds. Different lenders solely concentrate on rates of interest as a result of it’s simpler to do, however their clients find yourself dropping cash by not getting a full view of their funds.”

However as mortgage charges started climbing in 2022, the refinancing increase loved by the mortgage business as an entire started to dry up. LoanSnap’s originations that yr dwindled to 567 loans totaling $210 million, in response to the CFPB database.

Final yr, LoanSnap solely originated 42 loans totaling $3.59 million — a median steadiness of $85,476 per mortgage. The lender turned down 12 purposes, and debtors who submitted 68 purposes totaling $10.25 million withdrew them.

Connecticut Division of Banking examination

LoanSnap’s issues with Connecticut regulators — first reported by TechCrunch — date to an examination launched by the Shopper Credit score Division of the Connecticut Division of Banking in July 2022.

Of their preliminary cease and desist order filed towards the corporate in January, Connecticut regulators alleged that LoanSnap’s nationwide enterprise mannequin trusted using salespeople to do work that, legally, can solely be carried out by licensed mortgage mortgage originators.

That work included taking mortgage purposes, gathering monetary info comparable to financial institution statements, W-2s, tax returns and pay stubs, and advising potential debtors on their choices.

Combing by means of data, together with mortgage mortgage recordsdata and payroll data — and listening to recorded calls with customers in Connecticut and different states — financial institution examiners concluded that unlicensed LoanSnap name heart representatives made outbound calls to potential debtors utilizing leads from corporations like LendingTree.

The LoanSnap name heart reps would then make an preliminary willpower about whether or not the borrower certified for a mortgage product and advise them of their choices earlier than sending them to a licensed mortgage mortgage originator, Connecticut regulators alleged.

“The examination additionally discovered that if an unlicensed [salesperson] decided that respondent didn’t have ‘helpful choices’ for a possible borrower, they might so advise the potential borrower and would finish the decision with out permitting the potential borrower the chance to talk with a licensed mortgage mortgage originator,” regulators alleged.

As a substitute, examiners mentioned, prospects who supposedly didn’t qualify had been suggested {that a} “senior mortgage banker” would “overview the file and phone the potential borrower in the event that they decided that there have been any ‘helpful choices,’ successfully denying the potential borrower credit score.”

LoanSnap dropped demand for listening to

Connecticut regulators mentioned that LoanSnap offered a written response on Aug. 18, 2023, “denying, largely” the examiner’s findings, which regulators discovered “unpersuasive.”

In a May 15, 2024, consent order, LoanSnap agreed to pay a $75,000 civil penalty and requested a proper listening to within the hopes of retaining its license.

However LoanSnap dropped its demand for a listening to in Connecticut and agreed to the Oct. 2 consent order.

Based on that current order, the Connecticut Banking Commissioner had routinely suspended LoanSnap’s license on July 11, alleging that the corporate had moved its principal workplace in California with out submitting a change of handle with Nationwide Multistate Licensing System and Registry (NMLS) inside 30 days.

LoanSmart’s landlord, MGR OC1 LLC, had sued the corporate in Orange County in February, claiming it was owed $537,304 in again hire, and obtained an eviction with sheriff lock-out of the premises on Could 16, Connecticut regulators mentioned.

LoanSnap’s license additionally certified for automated suspension as a result of it had failed to supply a bond rider or endorsement to the surety bond on file with the state, the consent order mentioned. On July 24, Connecticut regulators mentioned they acquired discover from LoanSnap’s surety bond supplier, The Cincinnati Insurance coverage Firm, that the corporate’s bond can be canceled on Aug. 24.

Connecticut regulators additionally alleged that in making use of to resume its license in December, LoanSnap falsely acknowledged it had no unhappy judgments or liens towards it. However on Nov. 7, Wells Fargo had received a $431,511 judgment towards LoanSnap in a breach of contract lawsuit over a mortgage that it bought to the financial institution.

The consent order additionally detailed authorized actions by collectors together with Optimum Blue, Mortgage Capital Buying and selling, Anderson Tax LLC and South Road Securities, a few of which predated its license renewal request.

LoanSnap “fails to exhibit that its monetary accountability, character and common health are comparable to to command the arrogance of the group and to warrant a willpower that LoanSnap will function actually, pretty and effectively,” Connecticut regulators mentioned in summing up their case for revoking the corporate’s license.

In discussions with Connecticut regulators, “LoanSnap sought to barter the give up of its license to interact as a mortgage lender in Connecticut in lieu of revocation,” the consent order mentioned. “LoanSnap was suggested that as a result of excellent nature and extent of the above-referenced allegations, any give up request wouldn’t be accepted.”

California regulators notified LoanSnap on Aug. 19 of their intention to revoke the corporate’s mortgage lending license within the state, citing the Aug. 4 expiration of its surety bond.

Nonetheless open for enterprise?

Calls to LoanSnap Friday weren’t answered, and the corporate didn’t reply to emailed requests for remark from Inman. Though the corporate’s web site makes it seem that the corporate stays open for enterprise, clicking on a button to “Get Began” on making use of for one in all LoanSnap’s “SMART loans” generates an error.

Based on Connecticut regulators, LoanSnap was licensed to do mortgage enterprise in roughly 40 states in Aug. 2023. NMLS records present LoanSnap at the moment holds licenses in 13 states, together with California, and sponsors six mortgage mortgage originators.

On a website FAQ, LoanSnap says its companies can be found in 29 states — Alabama, Arkansas, Arizona, California, Colorado, Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kansas, Louisiana, Maryland, Michigan, Nebraska, New Hampshire, New Jersey, New Mexico, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Washington and Wisconsin.

“Should you reside exterior these states, we’re increasing as quick as we will and hope to be out there in your state quickly!” the web site states.

Connecticut regulators had additionally alleged that “LoanSnap marketed to customers on its web site that it was licensed in states during which it was not.”

In February, LoanSnap introduced it had been accepted to Visa’s Fintech Fast Track program, which the bank card big describes as s “program designed to assist fintech and crypto corporations carry new funds options to market.”

“This unparalleled achievement marks a major milestone within the mortgage business, positioning LoanSnap on the forefront of fintech innovation,” LoanSnap mentioned in a press release.

LoanSnap announced in April that it had joined NVIDIA Inception, a program the chipmaker says it created “to assist startups evolve quicker by means of cutting-edge expertise, alternatives to attach with enterprise capitalists, and entry to the most recent technical assets from NVIDIA.”

Visa and NVIDIA didn’t reply to Inman’s requests for touch upon LoanSnap’s continued participation within the applications.

Get Inman’s Mortgage Brief Newsletter delivered proper to your inbox. A weekly roundup of all the most important information on this planet of mortgages and closings delivered each Wednesday. Click here to subscribe.