Intel wild week leaves Wall Avenue unsure about chipmaker’s future

Intel CEO Patrick Gelsinger speaks on the Intel Ocotillo Campus in Chandler, Arizona, on March 20, 2024.

Brendan Smialowski | AFP | Getty Photographs

It was fairly per week for Intel.

The chipmaker, which has misplaced over half its worth this yr and final month had its worst day available on the market in 50 years after a disappointing earnings report, began the week on Monday by announcing that it is separating its manufacturing division from the core enterprise of designing and promoting laptop processors.

And late Friday, CNBC confirmed that Qualcomm has recently approached Intel a few takeover in what could be one of many greatest tech offers ever. It is not clear if Intel has engaged in conversations with Qualcomm, and representatives from each firms declined to remark. The Wall Avenue Journal was first to report on the matter.

The inventory rose 11% for the week, its finest efficiency since November.

The rally supplies little reduction to CEO Pat Gelsinger, who has had a tricky run since taking the helm in 2021. The 56-year-old firm misplaced its long-held title of world’s greatest chipmaker and has gotten trounced in synthetic intelligence chips by Nvidia, which is now valued at nearly $3 trillion, or greater than 30 occasions Intel’s market cap of simply over $90 billion. Intel mentioned in August that it is chopping 15,000 jobs, or greater than 15% of its workforce.

However Gelsinger continues to be calling the photographs and, for now, he says Intel is pushing ahead as an impartial firm with no plans to spin off the foundry. In a memo to workers on Monday, he mentioned the 2 halves are “higher collectively,” although the corporate is organising a separate inside unit for the foundry, with its personal board of administrators and governance construction and the potential to lift outdoors capital.

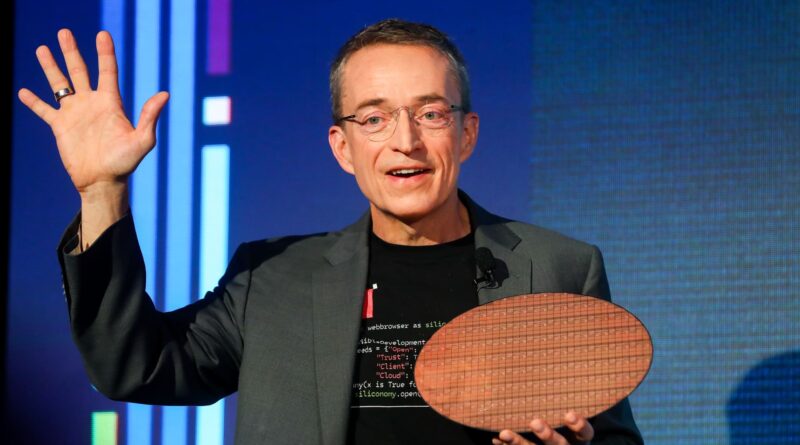

Intel CEO Pat Gelsinger speaks whereas displaying silicon wafers throughout an occasion known as AI In every single place in New York, Thursday, Dec. 14, 2023.

Seth Wenig | AP

For the corporate that put the silicon in Silicon Valley, the highway to revival is not getting any smoother. By forging forward as one firm, Intel has to 2 clear two gigantic hurdles directly: Spend more than $100 billion via 2029 to construct chip factories in 4 completely different states, whereas concurrently gaining a foothold within the AI growth that is defining the way forward for know-how.

Intel expects to spend roughly $25 billion this yr and $21.5 billion subsequent yr on its foundries in hopes that changing into a home producer will persuade U.S. chipmakers to onshore their manufacturing somewhat than counting on Taiwan Semiconductor Manufacturing Firm (TSMC) and Samsung.

That prospect could be extra palatable to Wall Avenue if Intel’s core enterprise was on the prime of its sport. However whereas Intel nonetheless makes the vast majority of processors on the coronary heart of PCs, laptops, and servers, it is dropping market share to Advanced Micro Devices and reporting income declines that threaten its money movement.

‘Subsequent part of this foundry journey’

With challenges mounting, the board met final weekend to debate the corporate’s technique.

Monday’s announcement on the brand new governance construction for the foundry enterprise served as a gap salvo meant to persuade investor that critical adjustments are underway as the corporate prepares to launch its manufacturing course of, known as 18A, subsequent yr. Intel mentioned it has seven merchandise in growth and that it landed a large buyer, asserting that Amazon would use its foundry to provide a networking chip.

“It was essential to say we’re transferring to the following part of this foundry journey,” Gelsinger informed CNBC’s Jon Fortt in an interview. “As we transfer to this subsequent part, it is far more about constructing effectivity into that and ensuring that we’ve got good shareholder return for these vital investments.”

Nonetheless, Gelsinger’s foundry guess will take years to repay. Intel mentioned within the memo that it did not count on significant gross sales from exterior prospects till 2027. And the corporate can even pause its fabrication efforts in Poland and Germany “by roughly two years primarily based on anticipated market demand,” whereas pulling again on its plans for its Malaysian manufacturing facility.

TSMC is the large within the chip fab world, manufacturing for firms together with Nvidia, Apple and Qualcomm. Its know-how permits fabless firms — people who outsource manufacturing — to make extra highly effective and environment friendly chips than what’s at the moment doable at quantity inside Intel’s factories. Even Intel makes use of TSMC for a few of its high-end PC processors.

Intel hasn’t introduced a big conventional American semiconductor buyer for its foundry, however Gelsinger mentioned to remain tuned.

“Some prospects are reluctant to provide their names due to the aggressive dynamics,” Gelsinger informed Fortt. “However we have seen a big uptick within the quantity of buyer pipeline exercise we’ve got underway.”

Previous to the Amazon announcement, Microsoft said earlier this yr it will use Intel Foundry to provide customized chips for its cloud companies, an settlement that could possibly be value $15 billion to Intel. Microsoft CEO Satya Nadella mentioned in February that it will use Intel to provide a chip, however did not present particulars. Intel has additionally signed up MediaTek, which primarily makes lower-end chips for cellphones.

U.S. President Joe Biden listens to Intel CEO Pat Gelsinger as he attends the groundbreaking of the brand new Intel semiconductor manufacturing facility in New Albany, Ohio, U.S., September 9, 2022.

Joshua Roberts | Reuters

Backed by the federal government

Intel’s greatest champion for the time being is the U.S. authorities, whish is pushing arduous to safe U.S.-based chip provide and restrict the nation’s reliance on Taiwan.

Intel mentioned this week that it acquired $3 billion to construct chips for the navy and intelligence businesses in a specialised facility known as a “safe enclave.” This system is classed, so Intel did not share specifics. Gelsinger additionally just lately met with Commerce Secretary Gina Raimondo, who’s loudly selling Intel’s future function in chip manufacturing.

Earlier this yr, Intel was awarded as much as $8.5 billion in CHIPS Act funding from the Biden administration and will obtain an extra $11 billion in loans from the laws, which was handed in 2022. Not one of the funds have been distributed but.

“On the finish of the day, I feel what policymakers need is for there to be a thriving American semiconductor business in America,” mentioned Anthony Rapa, a companion at regulation agency Clean Rome who focuses on worldwide commerce.

For now, Intel’s greatest foundry buyer is itself. The corporate began reporting the division’s funds this yr. For the newest quarter, which resulted in June, it had an working lack of $2.8 billion on income of $4.3 billion. Solely $77 million in income got here from exterior prospects.

Intel has a purpose of $15 billion in exterior foundry income by 2030.

Whereas this week’s announcement was seen by some analysts as step one to a sale or spinoff, Gelsinger mentioned that it was partially meant to assist win new prospects which may be involved about their mental property leaking out of the foundry and into Intel’s different enterprise.

“Intel believes that this may present exterior foundry prospects/suppliers with clearer separation,” JPMorgan Chase analysts, who’ve the equal of a promote ranking on the inventory, wrote in a report. “We consider this might in the end result in a spin out of the enterprise over the following few years.”

It doesn’t matter what occurs on that aspect of the home, Intel has to discover a repair for its predominant enterprise of Core PC chips and Xeon server chips.

Intel’s shopper computing group — the PC chip division — reported a few 25% drop in income from its peak in 2020 to final yr. The info heart division is down 40% over that stretch. Server chip quantity decreased 37% in 2023, whereas the associated fee to provide a server product rose.

Intel has added AI bits to its processors as a part of a push for brand new PC gross sales. However it nonetheless lacks a powerful AI chip competitor to Nvidia’s GPUs, that are dominating the information heart market. The Futurum Group’s Daniel Newman estimates that Intel’s Gaudi 3 AI accelerator solely contributed about $500 million to the corporate’s gross sales over the past yr, in contrast with Nvidia’s $47.5 billion in knowledge heart gross sales in its newest fiscal yr.

Newman is asking the identical query as many Intel traders about the place the corporate goes from right here.

“If you happen to pull these two issues aside, you go, ‘Effectively, what are they finest at anymore? Have they got the perfect course of? Have they got the perfect design?'” he mentioned. “I feel a part of what made them robust was that they did all of it.”

— CNBC’s Rohan Goswami contributed to this report