HomeServices Launched From Lengthy-Working Purchaser Fee Lawsuit

The second has arrived — the second to take cost. This summer time, at Inman Join Las Vegas, July 30-Aug 1, 2024, expertise the entire reinvention of a very powerful occasion in actual property. Be a part of your friends and the business’s greatest as we form the longer term — collectively. Learn more.

HomeServices will not should battle an antitrust fee lawsuit lodged by homebuyers towards the Nationwide Affiliation of Realtors and main actual property franchisors.

Decide Andrea R. Wooden

On Tues. Feb. 20, Decide Andrea Wooden of the U.S. District Courtroom for the Northern District of Illinois Japanese Division dismissed a declare made by the client plaintiffs’ underneath a federal antitrust legislation, however declined to toss practically all the plaintiffs’ claims underneath state antitrust legal guidelines.

The swimsuit, which seeks class-action standing and is called Batton 1, was initially filed by New Jersey homebuyer Judah Leeder in January 2021 and alleged NAR guidelines have inflated agent commissions and resulted in increased house costs paid by the consumers. In Could 2022, Wooden dismissed the suit, agreeing with the defendants that homebuyers are oblique purchasers of their purchaser dealer’s providers as a result of these providers are bought for them by homesellers, making these consumers ineligible for recovering damages from antitrust violators.

Wooden additionally famous on the time that homesellers, whom she mentioned had been the direct purchasers of purchaser dealer providers, had been pursuing an identical case in her jurisdiction, which labored towards the homebuyer’s swimsuit. That case is called Moehrl and it alleges fee sharing inflates vendor prices reasonably than purchaser prices. Wooden is similar decide overseeing the Moehrl case. Nonetheless, she gave the homebuyer plaintiff depart to amend his grievance.

In July 2022, eight homebuyers filed an amended complaint towards NAR, Realogy, Keller Williams, RE/MAX, HomeServices of America and three of the latter’s subsidiaries: BHH Associates, HSF Associates and The Lengthy & Foster Firms. The amended grievance terminated Leeder as its lead plaintiff and as an alternative featured eight new plaintiffs, lead by Mya Batton, who bought houses in Tennessee, Florida, Kansas, North Carolina, Nevada, Massachusetts, and New Mexico.

Along with the Sherman antitrust declare and the unjust enrichment declare of the unique swimsuit, the amended swimsuit accuses the defendants of violations of state antitrust statutes and client safety legal guidelines in 35 states as properly, together with Arizona, California, Connecticut, D.C., Florida, Hawaii, Idaho, Illinois, Iowa, Kansas, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Nevada, New Hampshire, New Mexico, New York, North Carolina, North Dakota, Oregon, Puerto Rico, Rhode Island, South Carolina, South Dakota, Tennessee, Utah, Virginia, Vermont, West Virginia, and Wisconsin.

The defendants responded to the amended grievance with motions to dismiss. In Wooden’s Feb. 20 order ruling on these motions, she mentioned that the amended grievance’s allegations concerning the federal declare looking for “injunctive aid” — an order forcing the defendants to cease their alleged unlawful habits — nonetheless “primarily mirror the allegations” within the unique grievance and he or she nonetheless believes homesellers reasonably than consumers are “higher suited” to hunt injunctive aid.

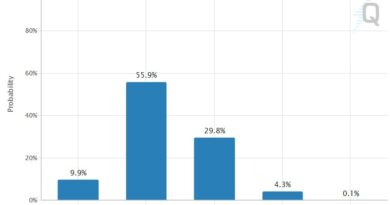

Wooden pointed to the current verdict within the case referred to as Sitzer/Burnett to bolster this viewpoint. In that case, a jury discovered that KW, RE/MAX, Anyplace, NAR, HomeServices, BHH Associates and HSF Associates, conspired to inflate dealer fee charges paid by homesellers. The jury awarded $1.78 billion in damages to a category of roughly 500,000 Missouri householders. If that award stands, it will be trebled by legislation to greater than $5.3 billion.

“To the extent a putative class member faces a big risk of damage from Defendants’ alleged antitrust violations of their capability as a purchaser, they might possible be concurrently uncovered to damage as a vendor too — i.e., they might be threatened with the identical damage as that suffered by the house vendor class licensed in Moehrl and Burnett,” Wooden wrote.

“This circumstance additional underscores that the house sellers are greatest located to hunt injunctive aid.”

She dismissed the federal declare “with out prejudice,” that means the plaintiffs can re-submit the declare with completely different arguments ought to they select to.

No less than for now, as a result of the federal declare didn’t survive, Wooden dismissed HomeServices and three of its subsidiaries — BHH Associates, HSF Associates and the Lengthy & Foster Firms — as defendants from the case — additionally with out prejudice.

“HomeServices Defendants argue that they aren’t topic to private jurisdiction in Illinois as a result of not one of the constituent entities are Illinois-based firms and the [complaint] fails to incorporate any allegations connecting them to Illinois,” Wooden’s order reads.

With no declare underneath which the courtroom can assert nationwide authority, the courtroom thus has no private jurisdiction over the HomeServices defendants, in accordance with Wooden.

“We had been happy to see the dismissal, and given the very fact it was based mostly on jurisdictional grounds and with out prejudice (to a possible refiling), we’re going to chorus from formally commenting as we wait to see if the plaintiffs take any further motion,” Chris Kelly, govt vice chairman for HomeServices, advised Inman in an announcement.

Inman has requested an lawyer for the plaintiffs for remark and can replace this story if and when a response is acquired.

The Batton 1 case had sought class certification on behalf of two proposed lessons: a nationwide injunctive aid class and a damages class. As a result of the federal declare was dismissed, solely the latter proposed class stays. That class is made up “All individuals who, since December 1, 1996 by the current, bought within the Oblique Purchaser States residential actual property that was listed on an NAR MLS.” For this class, the plaintiffs are asking for damages underneath “antitrust, unfair competitors, client safety, and unjust enrichment legal guidelines.”

Wooden allowed practically all the claims underneath state legal guidelines to proceed, noting that the U.S. Supreme Courtroom had dominated that states might permit oblique purchasers to recuperate damages underneath their very own antitrust legal guidelines.

She solely dismissed the amended grievance’s Tennessee antitrust and client safety legislation claims, which the plaintiffs had already voluntarily dismissed themselves, and a declare underneath the Kansas Client Safety Act (KCPA). Wooden dismissed the latter as a result of the plaintiffs claimed “it was misleading for buyer-brokers to promote their providers as free when, actually, their commissions are handed by to consumers as a result of the commissions are integrated into house costs,” however failed to claim that that misrepresentation was truly made to any plaintiff.

Nonetheless, Wooden was receptive to the plaintiffs’ argument that commissions are baked into house costs and that was one purpose she allowed the state-law claims to proceed.

“[T]he Courtroom finds Plaintiffs’ concept of damage comparatively easy,” Wooden wrote.

“A house vendor pays a complete fee meant to compensate each the buyer- and seller-brokers. Then, the MLS itemizing for the vendor’s house informs potential buyer-brokers of the set price at which they are going to be compensated in the event that they discover a purchaser for the house. Whereas a house vendor could also be content material to bear the prices related to the providers offered to them by their very own seller-broker, they are going to be much less prepared to pay for the buyer-broker’s providers, which, in fact, are rendered to the client reasonably than the vendor.

“It could due to this fact be economically rational for a house vendor to attempt to offset the prices they incur for providers offered to the client by elevating the value of the house they’re promoting by an quantity commensurate with the portion of the overall fee earmarked for the buyer-broker. Thus, as alleged, there’s a single, straight-line path by which the fee is handed by to the homebuyer.

“For that purpose, the Courtroom can’t conclude that the [amended complaint] fails to plead proximate causation as to any state-law declare.”

Learn the courtroom’s order:

Editor’s be aware: This story has been up to date with a remark from HomeServices.