Homebuyer Sentiment Tallies Document Low Amid Falling Charges

The decision is in — the previous method of doing enterprise is over. Be part of us at Inman Connect New York Jan. 23-25, when collectively we’ll conquer as we speak’s market challenges and put together for tomorrow’s alternatives. Defy the market and wager massive in your future.

Solely 14 p.c of Individuals surveyed final month stated November was an excellent time to purchase a house — a brand new file low in month-to-month surveys mortgage big Fannie Mae has been conducting since 2010. However the outcomes of Fannie Mae’s latest National Housing Survey, launched Thursday, might already be old-fashioned.

The survey of 1,058 owners and renters was carried out between Nov. 1 and Nov. 16, and most respondents have been contacted within the first two weeks of November, when mortgage charges have been simply starting a dramatic retreat from 2023 highs.

When the survey was taken, near half of customers have been anticipating that mortgage charges would proceed climbing into the stratosphere, and just one in 5 customers thought they might come down within the subsequent 12 months.

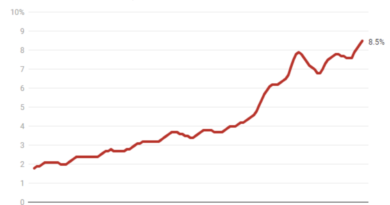

However come down they’ve: Charges for 30-year fixed-rate mortgages averaged 6.96 p.c Wednesday, down almost a full share level from a 2023 excessive of seven.83 registered on Oct. 25, based on day by day price lock knowledge tracked by Optimal Blue.

Whereas it is going to be one other month earlier than the complete affect of declining mortgage charges on client sentiment is understood, Fannie Mae Chief Economist Doug Duncan cautioned that there’s extra to client pessimism than elevated mortgage charges.

Persistent affordability challenges and worries about family funds are the first drivers of housing sentiment plateauing at a low stage, Duncan stated.

Doug Duncan

“Even when mortgage charges decline over the subsequent 12 months, which we at present anticipate, it’s unlikely to meaningfully have an effect on affordability,” Duncan stated, in an announcement. “The dearth of housing stock is prone to stay a problem for a while, and residential buy sentiment might proceed to be suppressed consequently. As our forecast signifies, we consider it is going to be a pair years earlier than residence gross sales return to extra regular, pre-pandemic ranges.”

In a Nov. 21 forecast, Fannie Mae economists stated they anticipate gross sales of present properties to drop to a seasonally adjusted annual price of three.9 million properties throughout the remaining three months of this 12 months, which might be the bottom tempo of gross sales since 2010.

Whereas Fannie Mae forecasters don’t see residence gross sales bottoming till Q1 2024, economists on the Mortgage Bankers Affiliation are extra optimistic, projecting that residence gross sales bottomed in Q3 2023 and are poised for eight consecutive quarters of progress.

One driver of the diverging forecasts is that Fannie Mae economists had predicted mortgage charges wouldn’t drop under 7 p.c till Q2 2025 — one thing that’s already occurred. Forecasters on the Mortgage Bankers Affiliation see mortgage rates coming back down into the mid-6 p.c vary by the tip of subsequent 12 months and persevering with to fall into the mid-5s by the tip of 2025.

Supply: Fannie Mae National Housing Survey, November 2023.

Practically half of customers surveyed by Fannie Mae within the first half of November (44 p.c) thought mortgage charges would proceed to climb over the subsequent 12 months, down from 47 p.c in October.

The proportion of customers who anticipated charges to come back down within the 12 months forward jumped 8 share factors from October to November, to 22 p.c, the very best stage in three years.

However even after that vital change in sentiment, just one in 5 customers had an inkling {that a} massive drop in charges was already underway.

Mortgage charges have eased within the wake of a string of stories suggesting that the economic system is slowing, and rising expectations amongst bond market traders who fund most mortgages that the Federal Reserve shouldn’t be solely carried out mountaineering charges, however will reverse course within the spring.

However as Duncan was cautious to level out, housing sentiment is about extra than simply mortgage charges.

Fannie Mae pulls six of a very powerful questions from the Nationwide Housing Survey and distills them right into a single quantity, the Fannie Mae Dwelling Buy Sentiment Index (HPSI).

Supply: Fannie Mae National Housing Survey, November 2023.

With 4 of the index’s six elements reducing from October to November (shopping for circumstances, promoting circumstances, job loss concern, and alter in family Revenue), the HPSI fell 0.6 factors to 64.3, bringing the index inside 7.6 factors of its all-time low of 56.7, registered in October 2022.

With client sentiment in regard to residence costs unchanged from November, the one element of the HPSI that improved in November was the outlook for mortgage charges.

Supply: Fannie Mae National Housing Survey, November 2023.

Solely 14 p.c of customers stated November was an excellent time to purchase, down from 15 p.c in October. And with the share who stated it was a nasty time to purchase remaining unchanged at 85 p.c, the online share of customers who stated it was an excellent time to purchase decreased by one share level month over month.

At detrimental 71 p.c, the online share of customers who stated it was an excellent time to purchase hit a brand new survey low for the third month in a row.

Supply: Fannie Mae National Housing Survey, November 2023.

Markets which can be difficult for consumers are sometimes favorable to sellers, however the share of customers who stated November was an excellent time to promote a house fell three share factors from October to 60 p.c.

Whereas most customers nonetheless noticed circumstances for sellers pretty much as good, the share who stated November was a nasty time to promote elevated to 40 p.c, up from 37 p.c in October. Consequently, the online share of those that stated it was an excellent time to promote decreased 5 share factors from October to 21 p.c.

Supply: Fannie Mae National Housing Survey, November 2023.

Most Individuals who’ve jobs aren’t involved about dropping them within the subsequent 12 months, however the share who say they’re involved about being unemployed trended up in November.

Shut to at least one in 4 of these surveyed by Fannie Mae in November (23 p.c) stated they have been involved about dropping their job within the 12 months forward, up from 21 p.c in October. With the share of customers who weren’t involved about dropping their jobs falling two share factors, to 76 p.c, the online share of those that stated they weren’t involved about dropping their job decreased by 4 share factors, to 53 p.c.

Supply: Fannie Mae National Housing Survey, November 2023.

Whereas Fed policymakers have been involved that rising wages are a driver of inflation, solely 19 p.c of households surveyed in November stated their revenue is considerably greater than a 12 months in the past, down from 20 p.c in October.

Family revenue was considerably decrease than a 12 months in the past amongst 12 p.c of households surveyed in November, up from 10 p.c in October.

With 68 p.c saying their family revenue was about the identical as a 12 months in the past, the online share of those that reported their family revenue was considerably greater decreased three share factors from October at 7 p.c.

Supply: Fannie Mae National Housing Survey, November 2023.

Many would-be homebuyers would undoubtedly welcome value declines, however the HPSI treats a rise in client confidence that costs will admire as a plus for housing sentiment.

Whereas residence value appreciation has cooled considerably within the final 12 months, 41 p.c of customers surveyed by Fannie Mae in November thought residence costs will go up over the subsequent 12 months, up from 40 p.c in October.

Nevertheless, the share of customers who anticipated residence costs will go down additionally elevated to 24 p.c, up from 23 p.c in October. Consequently, the online share of those that say residence costs will go up within the subsequent 12 months remained unchanged from October.

Has affect of the lock-in impact been overstated?

Elevated mortgage charges haven’t solely created affordability challenges for consumers however made many would-be sellers extra reluctant to place their properties in the marketplace as a result of they don’t need to quit the low price on their present mortgage.

The so-called mortgage price lock-in effect is considered one issue that’s made listings scarce in lots of markets.

The latest decline in mortgage charges might assist get some would-be sellers off the fence. However even when charges don’t proceed to slip, the affect of the lock-in impact might have been overstated.

Within the first quarter of 2023, Fannie Mae researchers used the Nationwide Housing Survey to ask owners in the event that they deliberate to remain longer of their present properties than initially supposed and, if that’s the case, why.

They discovered that solely 29 p.c of house owners with a mortgage deliberate to remain of their properties longer than they’d initially supposed. Amongst that group, just one in 5 (21 p.c) stated having a low mortgage price was the first motive for his or her change in plans.

Which means the lock-in impact is the largest issue delaying a transfer for less than about 6 p.c of all owners with mortgages, Fannie Mae researchers concluded in October.

A new report launched by Financial institution of America researchers this week helps that conclusion, discovering half of present owners would promote if their dream residence grew to become obtainable, and that 54 p.c would promote in the event that they discovered a extra inexpensive space to stay, even when it meant paying a better rate of interest for a brand new mortgage.

Different causes owners stated may persuade them to surrender their present mortgage price included:

- Job alternative or job relocation: 40 p.c

- Nicer neighborhood facilities: 40 p.c

- The necessity for a bigger residence or extra rooms: 38 p.c

Get Inman’s Mortgage Brief Newsletter delivered proper to your inbox. A weekly roundup of all the largest information on the planet of mortgages and closings delivered each Wednesday. Click here to subscribe.