Fed Chair Jerome Powell’s Try To Deflate Fee-Minimize Expectations Flops

The decision is in — the outdated manner of doing enterprise is over. Be a part of us at Inman Connect New York Jan. 23-25, when collectively we’ll conquer at this time’s market challenges and put together for tomorrow’s alternatives. Defy the market and wager massive in your future.

Federal Reserve Chair Jerome Powell seized on a scheduled talking look at Spelman Faculty Friday as a possibility to deflate rising expectations that the central financial institution may start decreasing rates of interest within the spring, dismissing such speak as untimely hypothesis.

However with extra knowledge pouring in that the economic system is cooling, bond market buyers interpreted Powell’s remarks as “jawboning” — rhetoric supposed to maintain rates of interest from falling too quickly with out the Fed having to truly take motion by elevating charges.

The Fed “is strongly dedicated to bringing inflation right down to 2 p.c over time, and to conserving coverage restrictive till we’re assured that inflation is on a path to that goal,” Powell stated in his prepared remarks at Spelman Faculty. “It might be untimely to conclude with confidence that we’ve got achieved a sufficiently restrictive stance, or to invest on when coverage may ease.”

Powell stated Fed policymakers are ready to lift rates of interest additional if wanted to battle inflation however are “making choices assembly by assembly, based mostly on the totality of the incoming knowledge and their implications for the outlook for financial exercise and inflation, in addition to the stability of dangers.”

Bond market buyers who fund most mortgages stay satisfied that the Federal Reserve is getting inflation below management and isn’t solely executed with fee hikes however will start decreasing charges within the spring to keep away from strangling the economic system.

The CME FedWatch Tool, which tracks futures markets to foretell the percentages of the Fed’s subsequent strikes, confirmed buyers on Friday noticed a 63 p.c likelihood of a number of Fed fee cuts by March 20, up from 43 p.c the day earlier than and 21 p.c on Nov. 24.

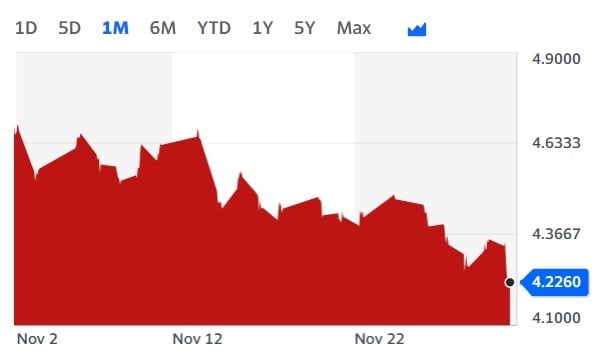

10-year Treasury yields maintain falling

Supply: Yahoo Finance.

Yields on 10-year Treasury notes, which regularly predict the place mortgage charges are headed subsequent, continued to development down dramatically Friday after Powell’s speech, falling 13 foundation factors to 4.23 p.c. Mortgage Information Each day’s lender survey confirmed charges on 30-year fixed-rate loans falling 6 foundation factors Friday, to 7.09 p.c.

With at this time’s drop, yields on 10-year Treasurys are down greater than three-quarters of a share level from a 2023 excessive of 5 p.c registered Oct. 22, the very best degree since 2007.

Rates of interest have been falling for greater than a month as report after report is available in exhibiting that the economic system is slowing quickly, and could possibly be headed for a recession.

Mortgage charges registered their biggest one-day drop in nearly four years on Nov. 14 after the Bureau of Labor Statistics reported that the all-items Shopper Value Index (CPI) fell to three.2 p.c in October, down from 3.7 p.c in September.

The Fed’s inflation gauge: Core PCE

On Wednesday, the Commerce Division reported that the core private consumption expenditures (PCE) worth index, a vital benchmark that excludes meals and vitality costs and which Fed policymakers need to see at 2 p.c, fell to three.5 p.c in October, down from 3.7 p.c in September and 4.7 p.c in Might.

“Total core PCE rose at solely a 2.2 p.c tempo within the three months to October, in comparison with the earlier three months, so the short-term fee of worth will increase is now very near the goal, and slowing,” economists at Pantheon Macroeconomics stated of their Dec. 1 U.S. Financial Monitor to purchasers. “However Chair Powell and his colleagues can’t afford to be flawed about upside inflation dangers twice in the identical cycle, in order that they want extra convincing than earlier Feds that inflation is again.”

Extra proof that the economic system is slowing got here Thursday within the type of a Department of Labor report exhibiting ongoing unemployment claims hit 1.927 million through the week ending Nov. 18, the very best degree since November 2021.

On Friday, the Institute for Provide Administration (ISM) reported that financial exercise within the manufacturing sector contracted in November for the thirteenth consecutive month.

The ISM’s Manufacturing PMI was unchanged at 46.7 p.c, undercutting expectations of economists polled by Reuters who had anticipated it to return in at 47.6 p.c. A Manufacturing PMI studying beneath 50 p.c signifies manufacturing is declining. A studying beneath 48.7 p.c, over a time frame, signifies that the general economic system (gross home product) is usually declining.

Bond market buyers additionally took coronary heart this week from remarks Federal Reserve Governor Christopher Waller made at an occasion hosted by the American Enterprise Institute. An inflation hawk, Waller stated he sees indicators that inflation is easing and that the Fed can be open to slicing charges if the development continues.

Forecasters at Pantheon Economics say that whereas spikes in core companies costs in July and September “look like remoted occasions,” Fed policymakers will need these occasions “to be firmly within the rear-view mirror earlier than they sign definitively that they’re executed mountain climbing, by no means thoughts easing.”

“We anticipate Chair Powell to stay cautiously optimistic at his press convention on Dec. 13, however not more than that,” Pantheon economists stated of the Fed’s subsequent scheduled assembly.

“When the Fed flip comes, nonetheless, we anticipate it to be fast,” Pantheon forecasters stated. “The mix of modest sequential worth will increase, slower financial progress, and a gradual uptrend in unemployment, will make it clear that sustaining nominal charges at their present degree will simply amplify the strain on an economic system which doesn’t should be squeezed arduous with a purpose to return inflation to the goal.”

Powell’s Spelman Faculty remarks

In a query and reply session with Spelman Faculty President Helene Gayle and college students on the traditionally black school for ladies in Atlanta, Powell caught to his mantra that the Fed continues to see inflation as a risk — and that incoming knowledge will decide whether or not to lift charges, go away them the place they’re, or carry them down.

“Coverage is at a restrictive degree, which means it’s holding the economic system again,” Powell stated. “Inflation continues to be working nicely above goal, however it’s shifting in the proper route. So we predict the proper factor to be doing now could be to be shifting rigorously.”

After implementing 11 fee will increase since March 2022 that introduced the short-term federal funds fee to a 22-year excessive of 5.25 p.c to five.5 p.c, Fed policymakers haven’t raised rates since July.

“Let the info reveal the suitable path,” he stated. “We don’t should be in a rush now, having moved rapidly and forcefully [to raise rates], we’re getting what we wished to get. We now have the power to maneuver rigorously.”

Lengthy-term charges stored climbing after Fed pause

Whereas the Fed has direct management over short-term rates of interest, long-term charges on authorities bonds and mortgage-backed securities rely on provide and investor demand.

Lengthy-term charges continued to development up for almost three months after the Fed was executed mountain climbing short-term charges, partially as a result of bond market buyers demanded larger term premiums to compensate them for the losses they might face if charges reverse.

The latest dramatic drop in long-term charges might in itself symbolize easing that permits the Fed to easily go away short-term charges the place they’re — the “increased for longer” technique — if the economic system appears to be like to be headed for a so-called tender touchdown moderately than a recession.

Of their Dec. 1 U.S. Financial Monitor, forecasters at Pantheon Macroeconomics stated they’re sticking to their view that the Fed will decrease short-term charges by 1.5 share factors subsequent yr, “beginning in March. The earlier, the higher.”

Forecasters at Fannie Mae and the Mortgage Bankers Affiliation agree that the U.S. is probably headed for a mild recession subsequent yr, though they differ on how a lot that might carry mortgage charges down.

Mortgage fee forecasts diverge

Supply: Fannie Mae and MBA forecasts, November 2023.

Of their Nov. 21 forecast, economists at Fannie Mae see the Fed pursuing the next for longer fee technique, which might maintain mortgage charges above 7 p.c subsequent yr.

However forecasters on the Mortgage Bankers Affiliation projected in a Nov. 17 forecast that mortgage charges will fall to the mid-6 p.c vary by the tip of subsequent yr and drop into the mid-fives by the tip of 2025.

Get Inman’s Mortgage Brief Newsletter delivered proper to your inbox. A weekly roundup of all the most important information on the planet of mortgages and closings delivered each Wednesday. Click here to subscribe.