Development In Residential, Rental And Mortgage Segments Raise Zillow In Q1

At Inman Connect Las Vegas, July 30-Aug. 1, 2024, the noise and misinformation shall be banished, all of your massive questions shall be answered, and new enterprise alternatives shall be revealed. Join us.

Zillow Group began the yr on the proper foot, as robust progress in its residential, rental and mortgage segments pushed its complete first-quarter income up 13 % yr over yr to $529 million — a efficiency that put the Seattle-based firm 5 % above the midpoint of its outlook vary.

As soon as once more, Zillow’s rental phase was the star of the present when it comes to proportion progress, with a bounce in multifamily income (+46 %) pushing the vertical’s total income up 31 % yr over yr to $97 million.

The mortgage phase additionally noticed robust progress, with revenues rising 19 % yearly to $31 million, primarily pushed by 130 % progress in Zillow Dwelling Loans buy mortgage origination quantity.

The corporate’s residential income improved in comparison with Q1 2023; nevertheless, it did not match the double-digit annual progress of the rental and mortgage segments at 9 %. Nonetheless, residential income, which incorporates Premier Agent, ShowingTime+ and Observe Up Boss, reached $393 million — accounting for the lion’s share of Zillow’s success.

Zillow’s losses elevated marginally throughout the quarter, rising 4.5 % from $22 million in Q1 2023 to $23 million in Q1 2024. Nevertheless, Q1 2024 marks a notable enchancment compared to Q4 2023, when the corporate tallied a internet lack of $73 million.

Wealthy Barton | Credit score: LinkedIn

Zillow co-founder and CEO Wealthy Barton stated he was happy with the company’s first-quarter performance, citing the residential phase’s progress outpaced the residential actual property trade’s complete transaction worth progress (4 %) based mostly on the Nationwide Affiliation of Realtors knowledge.

“Zillow’s robust income numbers throughout the enterprise helped us as soon as once more meaningfully outperform the residential actual property trade as we proceed to execute on our progress technique and broaden the breadth and depth of market protection for the housing tremendous app expertise in 2024,” Barton stated in a press release. “We’ve organically amassed and maintained a big, engaged viewers and powerful model, and we’ve been investing closely in software program to digitize and combine the end-to-end shifting transaction for customers, their brokers, and their mortgage officers.”

Barton and COO Jeremy Wacksman supplied extra perception within the firm’s shareholder letter.

The letter targeted on Zillow’s potential to chop by a “noisy trade surroundings” and keep the most important base of “high-intent prospects,” as evidenced by 2.3 billion visits to Zillow Group’s cell apps and websites throughout Q1. The corporate had 217 million common month-to-month distinctive customers throughout the identical interval, representing flat annual progress.

“This can be a hard-earned place that we’ve constructed over the previous 18 years,” the letter learn. “Zillow is searched extra on Google than the class time period ‘actual property’ and 3 times greater than the subsequent model within the class. Eighty % of our visitors is natural, and our app utilization is greater than 3 times that of anybody else within the class.”

“We’ve constructed and maintained such a robust model place due to our relentless concentrate on delivering distinctive tech improvements and buyer experiences — which we consider are our most vital investments,” it continued.

The letter goes on to not directly handle the growing criticisms Zillow has confronted this quarter, as CoStar founder and CEO Andy Florance grew to become more and more bullish in his pursuit of creating Properties.com the primary residential actual property portal within the U.S.

Florance’s technique features a $1 billion star-studded advertising campaign, the $1.6 billion acquisition of 3D scanning company Matterport, and the presumed energy of Properties.com’s “Your Itemizing, Your Lead” mannequin in comparison with Premier Agent within the face of impending buyer-broker commission model changes.

“With respect to the present state of the residential actual property trade, we’re happy that we’re shifting in direction of extra certainty,” the letter learn. “The long-running class-action swimsuit towards [NAR] and choose brokerages arrived at a proposed settlement in mid-March, and the decide simply granted preliminary approval of the settlement final week.”

“The substance of the settlement is what we’ve characterised as a really cheap ‘center path’ ahead for the trade, the place commissions are negotiated and communicated between patrons and sellers, and each events are higher educated,” it added. “Because the trade evolves, we consider that our model and viewers will thrive for 3 causes.”

These causes embody lots of the speaking factors Zillow leaders have targeted on over the previous yr, together with messaging surrounding the long-awaited “tremendous app” idea (Hint: it already exists as the Zillow app), the launch of an AI-powered itemizing platform by subsidiary ShowingTime+, and persevering with to forge strategic partnerships with brokerages and different portals.

Jeremy Wacksman

“Zillow is the main product innovator in residential actual property, with options corresponding to Actual Time Touring, Itemizing Showcase, and Zillow Dwelling Loans pre-qualified patrons,” Barton and Wacksman stated whereas highlighting Zillow’s 3D residence expertise, Aryeo pictures software program and Dotloop integrations. “We consider that brokers who work with our high-intent prospects and use our trade software program instruments are finest positioned to speed up their share in any model of an trade evolution from right here.”

The letter additionally combated conjecture in regards to the firm’s downfall in a post-settlement world, the place brokers would gravitate towards portals with extra inexpensive choices than Zillow, which prices a 40 % referral charge per transaction.

Zillow’s inventory fell after NAR’s March 15 announcement in regards to the settlement, which incorporates $418 million in damages and eradicating cooperative compensation particulars from a number of itemizing companies. The settlement additionally requires MLS members to have signed purchaser illustration agreements earlier than touring properties.

A month earlier than NAR’s announcement, Zillow acknowledged what a change in commissions might do to its residential phase, saying in a 10-Okay submitting {that a} “[reduction] within the advertising budgets of actual property companions or scale back the variety of actual property companions collaborating within the trade, which might adversely have an effect on our monetary situation and outcomes of operations.”

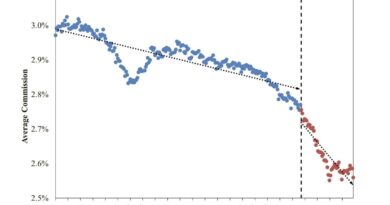

That preliminary concern has appeared to dissipate, with Zillow noting that its Premier Agent base has shrunk by 60 % since 2015. The remaining brokers, they stated, are excessive performers who nonetheless see the worth in Zillow’s lead era product.

“Premier Agent income has grown by greater than 2.5 instances [since 2015],” the letter learn. “Orienting our enterprise round the very best agent groups — those that present superior buyer experiences, have a confirmed potential to scale, and take advantage of cash to speculate alongside us — positions us nicely for potential shifts throughout the career.”

Barton and Wacksman stated Zillow will proceed to lean into the fee discourse, as evidenced by the short-term non-exclusive touring contract the portal launched on Tuesday.

The contract goals to assist patrons and patrons’ brokers navigate uncertainty round NAR’s settlement phrases that require a purchaser illustration settlement to be signed earlier than touring a house. The touring contract expires after seven days and doesn’t require exclusivity or compensation phrases, appearing as a stop-gap for homebuyers who may signal an unique, binding contract earlier than they’re prepared.

NAR supplied clarification about the buyer representation agreements on Wednesday, saying purchaser agreements don’t essentially mandate an company settlement. NAR additionally stated brokers have the liberty to find out the phrases of the settlement (e.g., someday, one month, one home, one ZIP code).

Zillow stated they consider touring conversion charges on the platform will proceed to be sturdy, as evidenced by double-digit variations in conversion charges in states that already abide by the client settlement necessities in NAR’s settlement versus ones that don’t.

“In Connecticut, the place purchaser agreements are required earlier than taking a purchaser on a tour, we’ve noticed 20 % increased conversion charges in contrast with our nationwide common,” the letter stated.

Wacksman stated this provides Zillow the boldness to push ahead on its progress plans for the Premier Agent Actual-Time Touring characteristic and the ShowingTime+ Itemizing Showcase.

The Actual-Time Touring characteristic will launch in 34 new markets by the top of Could, bringing the platform’s complete attain to 120 markets. In the meantime, they’re pushing to enhance adoption charges for Itemizing Showcase, with the aim of 5 % to 10 % itemizing protection.

“We’re testing purchaser settlement product flows now inside Zillow, and simply this week we launched a pilot of a consumer-friendly purchaser settlement in our touring expertise with a number of hundred Premier Agent companions,” he stated.

Within the firm’s Wednesday afternoon earnings name, Barton ended his statements by arguably taking a shot at CoStar whereas calling out trade members who’re relying on chaos to get forward.

“This can be a constructive evolutionary step for the trade,” he stated. “It’s not a revolution, as a few of those that consider they may revenue from chaos and disruption are proclaiming. Clear and negotiable compensation matches fairly nicely with our revealed shopper advocacy market.”

Zillow’s inventory (NASDAQ: Z) has been on a downward path for the previous month, with the value per share dropping from $48.22 on April 1 to $41.89 on Could 1.

Regardless of their bullishness, the corporate’s inventory didn’t expertise a post-earnings pop, as a substitute falling to $38.50 per share in after-hours buying and selling as a result of expectations that housing gross sales will stay flat throughout the second quarter.