DelPrete: Profitability Nonetheless Issues When Evaluating A Enterprise Mannequin

Mike DelPrete lays out the case for a wide range of monetary metrics and argues that, on the finish of the day, a enterprise ultimately must earn cash.

This text was shared right here with permission from Mike DelPrete for Inman Intel, a knowledge and analysis arm of Inman providing deep insights and market intelligence on the enterprise of residential actual property and proptech. Subscribe today.

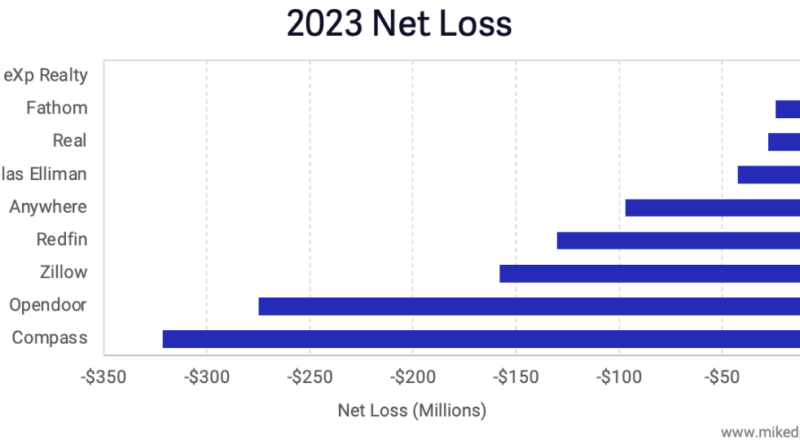

In 2023, the most important, publicly-listed actual property corporations had one other unprofitable 12 months with over $1.1 billion in losses.

Why it issues: Profitability is a vital metric — it’s a proxy for a wholesome enterprise mannequin that has product market match, is financially viable and might generate returns for shareholders.

Dig deeper: Internet revenue (or loss) is the usual, GAAP-friendly, apples-to-apples methodology to report an organization’s total monetary profitability (or lack thereof).

- Of all the general public corporations in the actual property ecosystem, eXp Realty was closest to profitability in 2023, whereas Compass and Opendoor had the most important losses.

Internet margin is an organization’s web loss proportional to its income — shedding $100 million is totally different for a corporation with $1 billion in income in comparison with an organization with $100 million in income.

- Internet margin is an illuminating measure of an organization’s enterprise mannequin; how efficient is it at producing earnings for shareholders? Is the corporate a money generator or a money incinerator?

- EXp as soon as once more comes out on prime, however the outlier is Redfin, which, proportional to income, was considerably much less worthwhile and fewer capital-efficient than its friends.

The Internet revenue of the “largest losers” is being dragged down by massive stock-based compensation bills (compensating employees with inventory choices and grants).

- In 2023, Zillow had $451 million in stock-based compensation expense, Compass $158 million and Opendoor $126 million.

- These fairness awards are a non-cash expense, however they do have a value: diluting shareholders.

With exponentially larger stock-based compensation expense than some other firm, Zillow is the noteworthy outlier within the chart above.

- With out it, the corporate could be materially worthwhile (together with eXp Realty and Actual).

Internet loss per transaction is one other methodology to focus on enterprise mannequin effectivity, much like OpEx per transaction.

- The low-fee brokerages, with decrease working bills, and Wherever with its massive franchise community, have the smallest web loss per transaction.

- Word: For Zillow, I’ve assumed 3 p.c of 4 million transactions.

Throwing Opendoor into the combo highlights the inherent challenges of iBuying: comparatively, and within the present market, it’s a a lot much less worthwhile enterprise.

The underside line: Profitability is just not the identical as money circulation; unprofitable companies usually are not essentially shedding cash or susceptible to going bankrupt.

- However it’s a legitimate measure to think about when evaluating the deserves of a selected enterprise mannequin — ultimately, a enterprise wants to earn cash.

- In the meanwhile, probably the most worthwhile — or least unprofitable — corporations are conventional brokerages, particularly cloud-based ones, whereas the disruptors and tech corporations proceed to wrestle with sustained profitability.

Mike DelPrete is a strategic adviser and international professional in actual property tech, together with Zavvie, an iBuyer provide aggregator. Join with him on LinkedIn.