AsterKey Makes Proof-Of-Funds Verification Simpler, Extra Safe: Tech Evaluation

AsterKey is a fintech app with actual property purposes, essentially the most notable being its skill to provide a safe, verified proof of funds letter whereas significantly minimizing the chance of publicity or fraud.

Are you receiving Inman’s Agent Edge? Be sure you’re subscribed for the most recent on actual property know-how from Inman’s knowledgeable Craig Rowe.

AsterKey is a fintech app for safe sharing of private monetary data.

Platforms: Cellular for iOS and Android

Perfect for: Homebuyers and their brokers

Prime promoting factors:

- Absolutely cell app

- Safe proof-of-funds verification

- Shops no knowledge

- Client-first

- ID-blind

- Private monetary statements/standing

Prime issues:

Probably, sluggish adoption on the true property entrance from a easy lack of information of its worth. The corporate must push to encourage actual property practitioners to know it till client adoption takes over.

What it’s best to know:

AsterKey, set for formal launch after the brand new yr, is a fintech app with plenty of useful makes use of to the true property business, essentially the most notable being its skill to provide a safe, verified proof of funds letter whereas significantly minimizing the chance of publicity or fraud. (Nothing is 100%.)

The appliance is rooted within the idea of consumer-permissioned data, a fast-growing banking precept that enables people to completely management who can entry personal monetary data, in lots of circumstances sharing solely particular elements of 1’s financial historical past. The app is closely consumer-forward, demonstrating an impressed and sensible consumer expertise on par with the very best client monetary apps available on the market — my Wells Fargo app solely modernized in the previous few weeks.

Customers hyperlink banking accounts by way of Plaid, and might embody funding portfolios, bank card stability, inventory holdings, checking and financial savings ledgers, and most types of asset information. It provides total monetary statements, web price assessments, indicators to separate manually enter knowledge from arduous verifications, and a quick, safe technique to present sellers, brokers and lenders what one is price.

In our demo, the co-founders of AsterKey jogged my memory that “consumers don’t own their financial identity.” It’s true. Mortgage officers, mortgage brokers and even actual property use an individual’s monetary background as some type of societal benchmark, a chess piece that both does or doesn’t have the power to maneuver an individual, or household, into an accepted place.

Susceptible to sounding naive, apps like AsterKey can at the very least present customers some semblance of possession over the selections made about our financial aspirations. In some ways, full management is a factor of the previous, a lot our knowledge is already on the market, however the siphon may be blocked. New apps and applied sciences are our there to assist us say, “Okay, that’s sufficient for now.”

I’m looking at you, Mr. Cooper.

AsterKey capabilities extra as a bridge between the supply of 1’s monetary knowledge and the entities who need it. Connecting accounts is simple by way of Plaid, which provides safe integrations with numerous banking establishments and powers plenty of essentially the most respected client apps used immediately.

An AsterKey monetary profile is “nameless,” which means apart from it being in your cellphone, there’s no approach for non-permissioned entities to hyperlink the info to an individual except specific permission is granted by the consumer. In these situations, the entity stays blind to the individual till they settle for the phrases of the mortgage or new monetary relationship.

The app makes use of KYC authentication upon arrange, which stands for Know Your Consumer (or buyer) and has origins within the Patriot Act of 2001. The method benchmarks an individual’s formal photograph ID in opposition to different on-line situations of their persona and is utilized in anti-money laundering efforts, world cash transfers and a number of types of digital monetary transactions.

Customers solely must undergo the steps upon preliminary setup of the app.

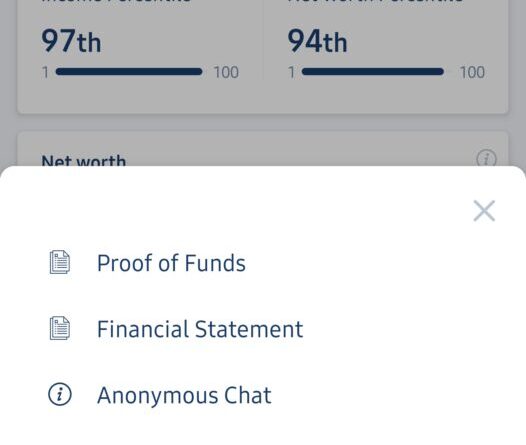

A proof of funds letter is generated in little time, launched by way of the Proof of Funds button on the app’s footer. Say goodbye to poorly typed casual letters, screenshots of on-line accounts (Significantly individuals?) or having to attend days for a purchaser to cobble collectively statements and paperwork for importing or handbook handoff. AsterKey generates a transparent, skilled doc based mostly on the accounts it’s verified within the app.

Brokers want to start considering arduous about how they work with patrons given the “risk” that they’ll must argue for direct cost within the very close to future in lieu of itemizing brokers sharing the fee. This sort of app might help an agent decide if a purchaser is who they are saying are, financially talking. The identical profit extends to brokers who work with property buyers. Bear in mind, a verified proof of funds letter and safe monitoring of 1’s monetary standing isn’t solely a profit to underwriters and mortgage officers, nevertheless it helps you, too. Nobody needs to be a part of some thousandaire’s grand phantasm of landlord mogulhood.

Make certain your patrons are who they declare to be. In any case, isn’t that just about what you’re asking once you point out a pre-approval letter?

AsterKey, and the bigger class of client apps to which it belongs, are an more and more highly effective profit for customers in an period of finance that also hovers between fax and Blockchain.

And sure, these sorts of apps are largely focused on the financially privileged, those that have the time and societal place to know threat, and the power to purchase a home. However, we will’t let an app’s intrinsic non-inclusiveness dictate its usefulness, and there’s immense profit to handing over to any client their skill to manage who is aware of one thing about them.

I encourage you to learn up on consumer-permissioned knowledge and the ever-increasing portfolio of fintech apps that overlap into proptech. Begin with this one.

Have a know-how product you want to focus on? E mail Craig Rowe.

Craig C. Rowe began in industrial actual property on the daybreak of the dot-com increase, serving to an array of business actual property corporations fortify their on-line presence and analyze inside software program choices. He now helps brokers with know-how choices and advertising and marketing by reviewing software program and tech for Inman.