Actual Property Investing In 2023: The Curler Coaster Continues

The decision is in — the previous means of doing enterprise is over. Be a part of us at Inman Connect New York Jan. 23-25, when collectively we’ll conquer at this time’s market challenges and put together for tomorrow’s alternatives. Defy the market and guess massive in your future.

Buyers knew they have been in for a roller coaster ride in 2023. What they nonetheless don’t know is the place the journey is heading subsequent.

Pandemic-era highs for nearly all sectors of actual property led to uncertainty in markets throughout the U.S. Lease started to reverse, workplace emptiness remained close to report highs, banks failed and lending received difficult.

On the Property Portfolio beat at Inman, we give attention to long-term leases, short-term leases, institutional traders, property administration and the broader enterprise of creating wealth through the use of actual property as an funding. Right here’s what we watched in 2023.

2023 shifted in renters’ favor

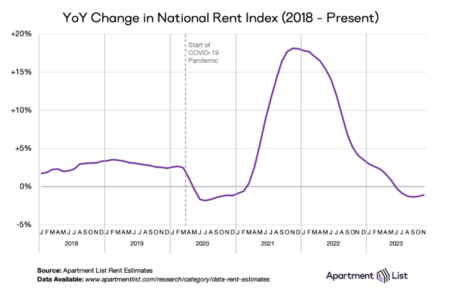

Renters gained the upper hand in markets throughout the nation as a rush of newly constructed flats have been accomplished, giving renters extra choices to select from and serving to settle down the rising value of month-to-month lease in 2023.

Condominium Checklist

That was welcome information for a lot of gamers, even together with some traders who dreaded the prospect of an extended interval of excessive rates of interest if the Federal Reserve failed to chill inflation rapidly.

Renters obtained a reprieve after two years of unprecedented lease progress pushed by the COVID housing market. It now prices $1,499 monthly to lease a one-bedroom house and $1,856 monthly for 2 bedrooms. Lease fell about 1.1 p.c in 2023, Condominium Checklist reported.

Whereas lease is falling getting into 2024, it’s nonetheless about $250 extra monthly than it was three years in the past, in keeping with Condominium Checklist.

An workplace sits vacant on Oct. 27, 2022, in San Francisco, California. (Picture by Justin Sullivan / Getty Pictures)

All eyes on workplace buildings as companies set ‘new regular’

Glenn Kelman of Redfin. Picture By: AJ Canaria of MoxiWorks

In April, Redfin CEO Glenn Kelman informed staff they’d be coming again to the workplace on a part-time foundation. It was a departure from the three years when the true property portal allowed its staff to work remotely full time.

It additionally got here at a time when cities throughout the nation are grappling with vacant workplace buildings which are serving to drive down the value of economic actual property.

Kelman’s change meant that a whole lot of staff can be coming again to a downtown workplace constructing at a time when buildings throughout the nation are sitting largely empty.

Consultants stated they count on that companies will proceed tweaking their insurance policies on the place staff can work, last strikes that may impression demand and values for workplace buildings. In the meantime, practically $150 billion of loans on these workplace buildings are coming due this 12 months, in keeping with CommercialEdge.

“In 2024, it’s sport time,” stated Scott Rechler, chief govt of RXR Realty, an proprietor of New York workplace buildings, informed The Wall Street Journal. “House owners and lenders are going to have to return to phrases as to the place values are, the place debt must be and right-sizing capital buildings for these buildings to achieve success.”

Institutional investors count on costs to fall all through 2024 earlier than having an opportunity to rebound.

Falling inflation relieves strain on Fed to maintain charges excessive

Federal Reserve Chairman Jerome Powell

By the center of the 12 months, economists started seeing signs that the Federal Reserve’s fast enhance within the federal funds charge was serving to cool inflation.

On the time, it wasn’t clear how lengthy the Fed would proceed its rate-hiking cycle. However a wave of studies heading into summer season gave traders and economists hope that the Fed would quickly start lowering the charges that impression borrowing prices.

After a couple of extra months of constructive information about inflation, the Fed introduced in December it was projecting three rate cuts in 2024, information that despatched inventory markets hovering to new report highs.

Buyers now count on that the federal funds charge might be no less than 100 foundation factors decrease than it’s now, according to CME Group.

Airbnb units goal squarely on lodge trade

Airbnb is by far the short-term rental powerhouse. In 2023, the agency and its leaders set their sights not on competing rental corporations however on a a lot bigger rival. Airbnb is actively working to seize market share from the a lot bigger lodge trade.

Brian Chesky | Airbnb CEO

“Whereas the lodge CEOs have stated they count on demand to drive costs up this summer season, we wish to even have costs average,” CEO Brian Chesky stated final 12 months. “We predict that’s going to usher in an entire new technology of vacationers to Airbnb.”

Motels have an inherent benefit over the newer short-term rental trade as cities the world over enact rules that may differ broadly. Airbnb confronted a setback in New York City, which successfully banned tens of 1000’s of short-term leases in September.

Nonetheless, town represented lower than 1 p.c of Airbnb’s complete income, analysts stated. The true menace to Airbnb’s ongoing enlargement plans would come if extra massive markets replicated New York Metropolis’s rules in 2024.

Buyers look to get artistic in high-rate atmosphere

Actual property traders concentrating on single-family leases have been stymied by a scarcity of provide and excessive rates of interest in 2023, sending many in quest of elusive offers that required many to get creative.

Within the absence of distressed houses to purchase, repair and resell at a revenue, and with an ongoing slowdown in lease progress, traders stated they have been working with owners on methods to work collectively with out really shopping for or promoting houses.

“I all the time say the market predicts your funding technique,” actual property investor Mike DelPrete said. “You need to be well-versed in every technique. You’re like a health care provider, you’re diagnosing every scenario.”

Buyers started searching for subject-to financing, the place the investor makes funds on an present mortgage and on behalf of the proprietor, permitting for better-than-market charge borrowing prices.

One other sort of artistic financing that emerged in 2023 was a vendor carryback, the place a property proprietor has paid off a mortgage however doesn’t essentially want or wish to promote the home. The investor and proprietor conform to phrases based mostly on the power of the property to cashflow.

Condominium pipeline dries up

Jay Parsons | RealPage chief economist

Excessive lending prices — paired with excessive costs for buildings and labor — helped to close off the event pipeline for brand new condominium buildings throughout the nation.

Buildings that have been below building in 2023 might be completed this 12 months, including to what has turn into a glut of new supply in markets throughout the nation. That ought to hold downward strain on rents, trade consultants stated.

Lengthy-term, although, it could spell a brand new interval of excessive lease progress after the leases which are being completed now are stuffed and there’s little new provide coming behind it.

“I believe rents nationally will stay pretty flat for some time, particularly provided that new provide volumes will additional spike (and peak) in 2024,” Jay Parsons, chief economist of lease information agency RealPage, stated. “Provide will drop off starting in 2025 and extra dramatically by 2026, which (assuming an honest financial system) ought to permit demand to catch as much as provide and rents to rebound.”