2024 Might Be Worst Yr For House Gross sales Since 1995: Fannie Mae

Whether or not it’s refining your enterprise mannequin, mastering new applied sciences, or discovering methods to capitalize on the subsequent market surge, Inman Connect New York will put together you to take daring steps ahead. The Subsequent Chapter is about to start. Be a part of it. Join us and hundreds of actual property leaders Jan. 22-24, 2025.

This 12 months is shaping as much as be the slowest 12 months for gross sales of present properties in almost 30 years, with falling mortgage charges not anticipated to have an effect on gross sales till subsequent 12 months, Fannie Mae economists mentioned of their newest housing forecast this week.

Nationally, listings are up greater than 20 p.c from a 12 months in the past. However the dramatic improve in dwelling costs seen in the course of the pandemic continues to pose affordability challenges for patrons in lots of markets, Fannie Mae forecasters mentioned.

TAKE THE INMAN INTEL INDEX SURVEY FOR SEPTEMBER

Actual property brokers wish to remind their purchasers that every one housing is native, and Fannie Mae economists do see appreciable regional variation in itemizing provide.

Probably the most dramatic will increase in for-sale inventories have been within the Solar Belt and Mountain West areas, however “on the nationwide stage the provision scarcity very a lot applies,” Fannie Mae Chief Economist Doug Duncan mentioned in a statement.

And whereas listings are trending up strongly in components of the South and West, Fannie Mae economists suppose “some mixture of easing mortgage charges and smooth dwelling value progress relative to earnings progress in these areas will probably be wanted earlier than present dwelling gross sales start to meaningfully rise.”

The day after Fannie Mae issued its forecast, the Nationwide Affiliation of Realtors reported that existing-home gross sales declined 4.2 p.c from a 12 months in the past in August, to a seasonally adjusted annual tempo of three.86 million gross sales.

House gross sales anticipated to rebound in 2025

Supply: Fannie Mae Housing Forecast, September 2024.

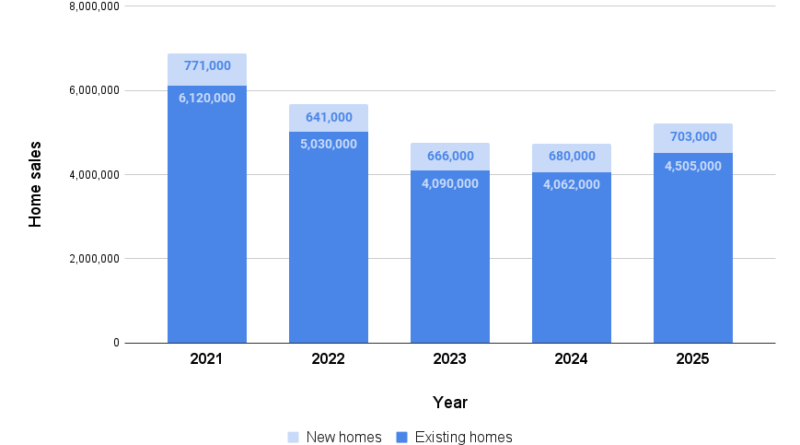

Fannie Mae economists are forecasting that 2024 dwelling gross sales will complete 4.74 million — the slowest tempo since 1995.

That might symbolize solely a slight drop of 14,000 gross sales from a 12 months in the past when dwelling gross sales plummeted 16 p.c as rising mortgage charges created affordability challenges for patrons and left many would-be sellers feeling locked into the low price on their mortgage.

Doug Duncan

The decline in gross sales is predicted to be cushioned by a 2.2 p.c uptick in gross sales of recent properties, to 680,000. However gross sales of present properties at the moment are projected to shrink by 0.7 p.c this 12 months, to 4.062 million.

“Though mortgage charges have fallen significantly in current weeks, we’ve not seen proof of a corresponding improve in mortgage software exercise, nor has there been an enchancment in client homebuying sentiment,” Duncan mentioned.

Subsequent 12 months, Fannie Mae expects dwelling gross sales to rebound by 9.8 p.c, to five.209 million, as mortgage charges retreat beneath 6 p.c and “affordability slowly improves and lock-in results weaken.”

Current dwelling gross sales are anticipated to steer the cost, rising by 10.9 p.c, to 4.505 million, with new dwelling gross sales projected to develop by a extra modest 3.3 p.c, to 703,000.

Good time to promote? It relies on the place you reside

Supply: National Housing Survey analysis by Fannie Mae Financial & Strategic Analysis Group.

Fannie Mae’s month-to-month National Housing Survey exhibits a widening divergence in regional perceptions about promoting circumstances.

Within the Northeast, the place inventories are tight and houses spend much less time available on the market, Individuals more and more say it’s a superb time to promote. However customers within the South “have turn into extra downbeat about promoting circumstances,” Fannie Mae economists mentioned in commentary accompanying their forecast.

Many of the progress in listings has occurred within the Solar Belt and some Mountain West states, and a few of these states now have for-sale inventories “close to and even above what was accessible pre-pandemic on the finish of 2019,” Fannie Mae economists famous. “Nevertheless, many of the Northeast and Midwest proceed to have close to cycle lows of properties accessible on the market.”

NAR reported Thursday that present dwelling gross sales — which embrace single-family properties, townhomes, condominiums and co-ops — had been down 6 p.c from a 12 months in the past within the South, whereas the Northeast was the one area the place gross sales didn’t decline 12 months over 12 months.

In response to NAR, the 1.35 million properties available on the market on the finish of August nationwide represented a 22.7 p.c improve from a 12 months in the past. On the present tempo of gross sales, that’s a 4.2-month provide of listings, up from 3.3 months on the similar time a 12 months in the past.

Some housing economists view a 6-month supply of homes as a balanced market, with patrons gaining the higher hand as the provision of listings climbs above that mark.

Lawrence Yun

“The rise in stock — and, extra technically, the accompanying months’ provide — implies homebuyers are in a much-improved place to search out the proper dwelling and at extra favorable costs,” NAR Chief Economist Lawrence Yun mentioned of the info. “Nevertheless, in areas the place provide stays restricted, like many markets within the Northeast, sellers nonetheless seem to carry the higher hand.”

Mortgage charges anticipated to drop beneath 6%

Supply: Fannie Mae Housing Forecast, September 2024 and Mortgage Bankers Association forecast August 2024.

Though Fannie Mae’s forecast was accomplished earlier than the Federal Reserve slashed short-term interest rates by 50 foundation factors Wednesday, it took under consideration expectations that the Fed will decrease charges because the economic system cools. Fannie Mae forecasters had assumed the Fed would reduce charges by 25 foundation factors this week, adopted by equally modest cuts in November and December.

Noting that long-term charges have already come down in current months in anticipation that the Fed would shift gears, Fannie Mae predicted charges on 30-year fixed-rate mortgages wouldn’t drop beneath 6 p.c till the second quarter of 2025, and common 5.7 p.c in This fall 2025.

“Nevertheless, rates of interest stay risky, significantly given adjustments to Fed coverage expectations, which provides danger to our outlook,” Fannie Mae economists famous.

Forecasters on the Mortgage Bankers Affiliation predicted an analogous downward trajectory for charges in an Aug. 15 forecast.

Fee-lock information tracked by Optimal Blue exhibits that after hitting a brand new 2024 low of 6.03 p.c Tuesday, charges on 30-year fixed-rate conforming mortgages bounced again on Wednesday and Thursday, with bond market traders who fund most mortgages having already priced in a Fed price reduce.

House costs boosting 2024 mortgage quantity

Supply: Fannie Mae Housing Forecast, September 2024.

Whereas dwelling value appreciation is cooling, the truth that costs proceed to rise in lots of markets signifies that mortgage lenders are nonetheless on monitor to originate extra buy loans by greenback quantity this 12 months than final.

This 12 months’s decline in mortgage charges also needs to assist increase refinancing quantity, with larger positive aspects anticipated subsequent 12 months.

Fannie Mae economists count on complete mortgage originations to rise 14 p.c in 2024, to $1.68 trillion, adopted by 28 p.c progress in 2025, to $2.155 trillion.

Even with gross sales anticipated to be flat, buy mortgage originations are forecast to develop by 7 p.c in 2024, to $1.305 trillion. Falling mortgage charges are anticipated to assist increase refinancings by 51 p.c this 12 months, to $375 billion.

Subsequent 12 months, buy mortgage originations are forecast to develop 15 p.c to $1.506 trillion and refinancings by 73 p.c, to $649 billion.

Get Inman’s Mortgage Brief Newsletter delivered proper to your inbox. A weekly roundup of all the most important information on the earth of mortgages and closings delivered each Wednesday. Click here to subscribe.